|

Home DH-debate A Short View of Russia End of Laissez-Faire Auri Sacra Fames National Self-Sufficiency An open Letter to President Roosevelt |

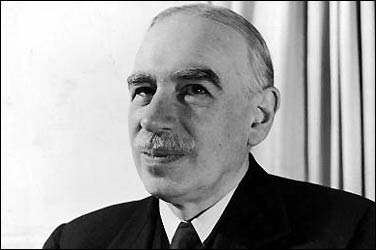

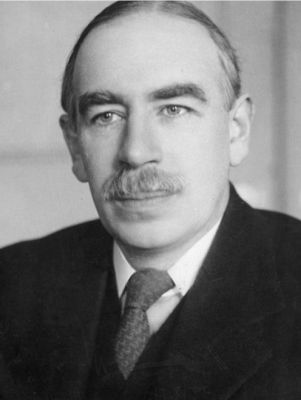

John Maynard Keynes was the most influential economist of the twentieth century. His economic theory gave the key to end the Great Depression of the thirties.

John Maynard Keynes 1883-1946.

He was born into an academic family in Cambridge. He had two younger siblings. The father John Neville Keynes taught in political economics, logic and ethics at Cambridge University. In his schooldays at Eton, the young Keynes particularly excelled in mathematics.

In 1905 he took the civil servant exam and got a job in the India Office. In his spare time, he worked on a book about mathematical probability. In 1909 he began to teach economics at Cambridge.

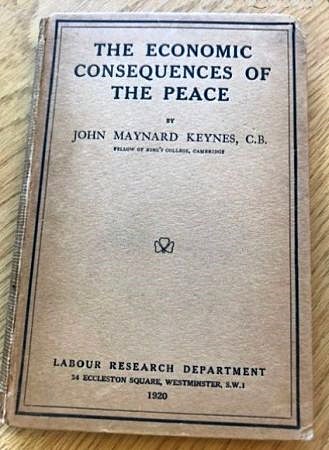

During the First World War, he worked for the English government in charge of foreign currencies and relations with allies. At the 1919 peace talks in Versailles, he was secretary of the English delegation - until he interrupted his stay, traveled home and wrote the book "The Economic Consequences of Peace", which made him world famous.

Lydia Lopokova and John M. Keynes - perhaps in 1926 or shortly after. Photo by Walter Benington Wikimedia Commens

During the interwar period, he made himself a significant personal fortune thanks to investments. He became a board member of a number of companies and a prominent supporter of the arts. Which harmonizes well with his lifelong belief that man does not live on bread alone - that Western civilization is on a blind track because it focuses too much on growth, individualism and profitability calculations and displaces religion and cultural and spiritual community. Among other things, he had a theater built in Cambridge.

In 1926 he married the Russian ballet dancer Lydia Lopokova. Together they traveled to Soviet Russia to visit Lydia's family. After returning home, he wrote "A Short View of Russia", in which he analyzed Leninism considered a religion.

When the thirties' great depression developed in the United States with factory closures and growing unemployment, he outlined his solution in two "open letters" to Franklin D. Roosevelt in December 1933 and June 1934, as well as in some speeches he made in England, in which he assessed the results of the American "New Deal" policy and argued for governments' "deficit spending" as the most effective means of halting the great economic crisis.

Keynes in conversation with the philosopher Bertrand Russell on the left and the author Lytton Strachey on the right in 1915. Foto National Portrait Gallery.

The philosopher Bertrand Russell recounted that Keynes was the most intelligent person he had ever known. He said that "every time I argued with Keynes I took my life in my hands, and I seldom emerged without feeling something of a fool."

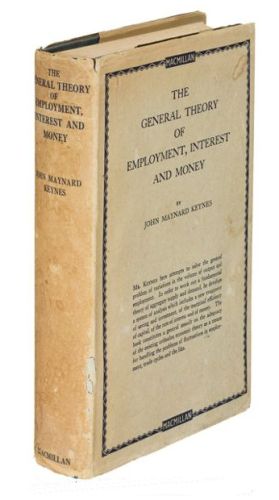

In 1936, Keynes published his main work, "The General Theory of Employment, Interest and Money" which included the messages in most of the articles he had previously published. It was basically a frontal attack on the classical economists. It represented a turning point in economic theory called the "Keynesian Revolution". The book's main message was that the labor market will not by itself stabilize at a point characterized by full employment, and state interventionism is therefore necessary to overcome serious economic crises.

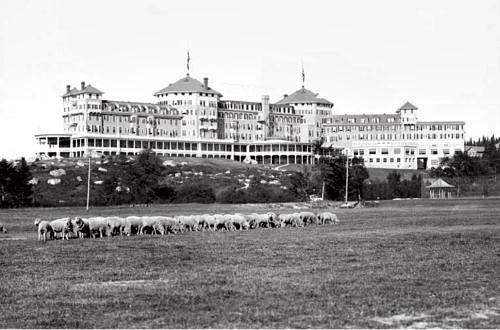

Keynes at the 1944 Bretton Woods Conference in Conversation with the Soviet Representative. Photo National Archives.

In 1944, he attended the Bretton Woods International Conference in the United States as head of the British Delegation. The purpose of the conference was to organize the international economic system for the coming post-war period. The World Bank and IMF were founded. At this conference, Keynes proposed establishing an international reference currency, as a kind of overall global settlement currency. He did not get his proposal through, mainly due to American resistence. After the war, the dollar became, in practice, the international reserve currency, to the great benefit of the American economy.

Keynes was not the only economist to understand that capitalist economies are prone to periodic depressions, nor was he the only economist of his generation to conclude that aggregate demand could fall below the level required to ensure full employment. However, Keynes was already a major figure in British economics and politics at a time when Britain was a much more important world power than it is today, and therefore his ideas on how to solve the depression problem gained much greater influence than the same ideas would have obtained if they had come from other economists.

Communist procession in Moscow in 1924 on the occasion of Lenin's funeral. Keynes regarded communism as completely useless as an economic system, but, as religion he considered it very dangerous. Photo The Article.

One speaks of the "Keynesian revolution", but it will be a big mistake to believe that Keynes had in any way subversive ideas, on the contrary, he was a convinced anti-revolutionary thinker. His theories were all aimed at preserving and strengthening capitalism by ensuring stability, employment and growth.

Han skrev i "The End of Laissez-faire": "For my part I think that capitalism, wisely managed, can probably be made more efficient for attaining economic ends than any alternative system yet in sight, but that in itself it is in many ways extremely objectionable. Our problem is to work out a social organisation which shall be as efficient as possible without offending our notions of a satisfactory way of life."

In "A Short View of Russia", he wrote: "In Western industrial conditions the tactics of Red Revolution would throw the whole population into a pit of poverty and death."

John Maynard Keynes died at the age of only 62 of a heart attack at his farmhouse in East Sussex in April 1946.

At the Versailles peace negotiations in 1919 after World War I, Keynes represented the British Chancellor of the Exchequer.

The story was that in the autumn of 1918 it became clear to German leaders that a defeat was inevitable. After four years of terrible fighting, Germany no longer had the men or resources to resist the Allies, who had received a big boost on the arrival of huge American supplies and millions of American soldiers to the war scene in France. Therefore, the German government contacted US President Woodrow Wilson and asked him to arrange a ceasefire on the basis of the "fourteen points" he had previously proclaimed as a condition of a "just and stable peace". On 11/11 1918, the armistice came into force, and the First World War ended.

French Prime Minister Clemenceau and US President Woodrow Wilson in Versailles. Foto Library of Congress

In the subsequent peace negotiations in Versailles, it became quickly clear that the final peace treaty would only have a superficial resemblance to the fourteen points that Wilson had proposed and which were accepted by the Germans at the ceasefire.

The blame for the war was laid unilaterally on Germany, which therefore had to disarm and pay a monster fine of over 30 billion dollars, which was far beyond the nation's ability to pay. Germany did not have a seat at the negotiating table in Versailles, which were exclusively negotiations between the Allies on what conditions Germany should be imposed. To ensure that Germany would sign, the German merchant navy and fishing vessels had been confiscated and the country was isolated by an Allied naval blockade, which prevented the import of vital food.

Keynes was appalled by the terms of the peace treaty and presented a plan to the allied leaders, according to which the German government should have a substantial loan and permission to buy food, while the country immediately began making compensation payments. British Prime Minister Lloyd George approved the "Keynesian plan", but US President Wilson and French prime minister Clemenceau rejected it.

On June 5, 1919, Keynes wrote a message to Lloyd George informing him that he was resigning in protest of the impending "destruction of Europe."

The Economic Consequences of the Peace. Photo The Marshall Library Blog.

He then traveled home and wrote the book "The Economic Consequences of the Peace", which was published in December 1919. The message of the book was that Europe would not thrive without a just, efficient and integrated economic system, which was not possible under the economic conditions of the treaty.

In the book, he called the Treaty of Versailles a "Carthaginian peace". He believed that the Allies in the peace treaty had failed the promises they had made in the ceasefire agreement in terms of compensation, territorial adjustments and uniformity in economic conditions.

Rather, he wrote, one should have followed the more fair principles of lasting peace, embodied in President Woodrow Wilson's fourteen points, which Germany had accepted at the ceasefire. He wrote: "I believe that the campaign to get Germany to pay for the general costs of the war was one of the most serious acts of political ignorance for which our statesmen have ever been responsible." He believed that the amount that Germany was asked to pay in compensation was many times greater than it was possible for Germany to pay, and that this demand would create dramatic instability and promote a desire for revenge. As we know, he was sadly right.

The book became a best-seller and made him world famous.

Keynes has become known in the history of economic theory as the man, who made inflation respectable. He warned against devastating hyperinflation but ultimately meant that a lesser inflation of about two percent in many ways was beneficial to the economy of the society.

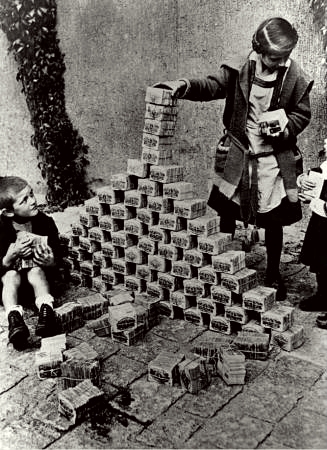

Hyperinflation in Germany in the early 1920's. Photo Pinterest.

In "The Economic Consequences of the Peace" from 1919 he described the devastating consequences of a possible future hyperinflation: "Lenin is said to have declared that the best way to destroy the capitalist system was to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily" The citizens only have the number of monetary units that they have saved, and their value is constantly reduced by the rate of inflation, while governments can print all the money they find appropriate.

In "Social Consequences of Changes in The Value of Money" from 1923 he outweighs inflation to deflation: "Thus inflation is unjust and deflation is inexpedient. Of the two perhaps deflation is, if we rule out exaggerated inflations such as that of Germany, the worse; because it is worse, in an impoverished world, to provoke unemployment than to disappoint the rentier. But it is necessary that we should weigh one evil against the other. It is easier to agree that both are evils to be shunned."

Keynes at a meeting in Germany in 1922, which aimed to stabilize the German mark. Photo Sueddeutche Zeitung.

Herbert Hoover, who had been the American president during most of the crisis, lost greatly in the presidential elections in November 1932 to the democrat Franklin D. Roosevelt. During the election campaign, he had campaigned against Roosevelt's proposal, which he believed would increase inflation.

In his open letter to president Roosevelt, Keynes patiently explained that a small inflation, in general, is merely a sign of economic health that should not deter him: "Now there are indications that two technical fallacies may have affected the policy of your administration. The first relates to the part played in recovery by rising prices. Rising prices are to be welcomed because they are usually a symptom of rising output and employment. When more purchasing power is spent, one expects rising output at rising prices. Since there cannot be rising output without rising prices, it is essential to ensure that the recovery shall not be held back by the insufficiency of the supply of money to support the increased monetary turn-over."

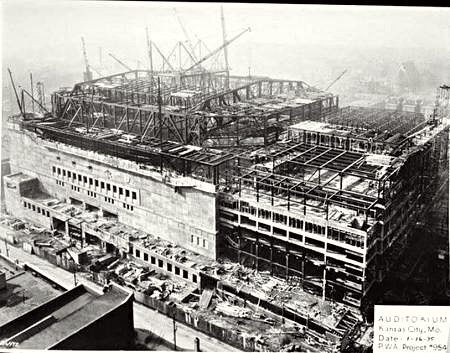

KC Municipal Auditorium in Kansas City under construction in 1935. It was built as part of the New Deal.

However, rising prices, as a result of limited supply, will be a sign that the economy has problems: "But there is much less to be said in favour of rising prices, if they are brought about at the expense of rising output. Some debtors may be helped, but the national recovery as a whole will be retarded. Thus rising prices caused by deliberately increasing prime costs or by restricting output have a vastly inferior value to rising prices which are the natural result of an increase in the nation's purchasing power."

Keynes explained that the president should not for fear of inflation shy away from increasing the amount of money as needed: "The other set of fallacies, of which I fear the influence, arises out of a crude economic doctrine commonly known as the Quantity Theory of Money. Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States to-day your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money, which is only a limiting factor, rather than the volume of expenditure, which is the operative factor."

Money illusion - It is easier for employees to accept a small inflation than an equivalent salary reduction. Drawing from Market Business News.

Companies need to reward employees, who have done a good job with wage increases. In general, it is not used directly to reduce the pay for employees, who have done less well, as this can cause very negative reactions. Therefore, the overall wage level in a company may have a constantly rising trend. However, if there is an inflation of maybe two percent, this will counteract the rising labor costs. It is easier for employees to accept two percent inflation, which affects everyone than to accept a personal salary reduction of two percent. It is called the "money illusion", although the author can not see that Keynes has used this expression.

With his own words in "General Theory": "Whilst workers will usually resist a reduction of money-wages, it is not their practice to withdraw their labour whenever there is a rise in the price of wage-goods" and later: "it would be impracticable to resist every reduction of real wages, due to a change in the purchasing power of money, which affects all workers alike" and even later: "whereas they do not resist reductions of real wages, which are associated with increases in aggregate employment and leave relative money-wages unchanged"

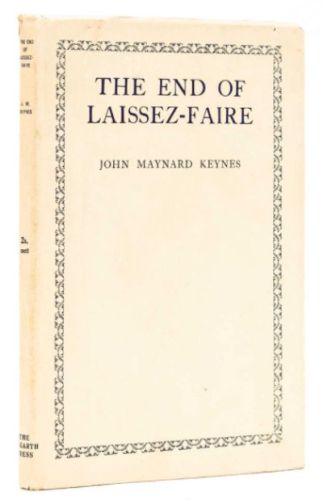

In connection with a speech in Germany in 1926, Keynes published an article entitled "The End of Laissez-Faire", in which he warned against imagining that eternal economic laws of supply and demand supported a market economy thereby making it stable.

John Maynard Keynes as a relatively young man - probably around 1926. Photo wikipedia.

The term "laissez-faire" denotes the idea that governments should completely refrain from intervening in the market in any way allowing it to develop "naturally".

Keynes was of the firm belief that there are no serious alternatives to capitalism in the current historical situation of the Western World - but it must be "wisely led". He wrote of Marxism: "But Marxist socialism must always remain a warning in the history of ideas - how can a doctrine so illogical and so blurred have exerted such a powerful and lasting influence on human consciousness, and through them, the events of history?".

It is the nature of capitalism that agents must have the freedom to make their financial decisions, as they see fit, within the framework of necessary laws on product liability etc. But he points out that it is wrong to believe that the market will automatically always ensure optimal decisions only because it seems to be governed by the eternal and unchangeable economic laws of the opposing market forces.

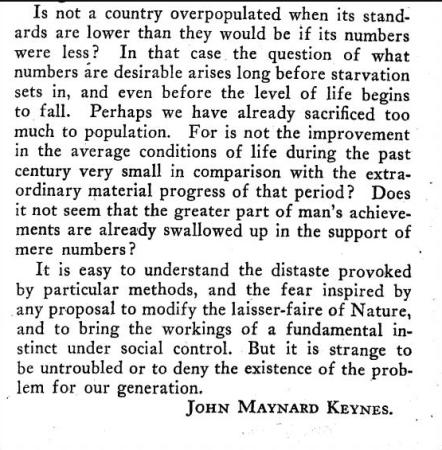

"The End of Laissez-Faire" by John Maynard Keynes 1926.

Governments have the overall political responsibility, and situations may arise where market intervention is necessary - as, for example, later, in 1933, with the Great Depression.

He demonstrates with many examples that many popular phrases and assumptions that support the idea of the market complete freedom from government interference have arisen from certain interpretations of the classical economists and philosophers: "It is not true that individuals possess a prescriptive "natural liberty" in their economic activities. There is no "compact" conferring perpetual rights on those who Have or on those who Acquire. The world is not so governed from above that private and social interest always coincide. It is not so managed here below that in practice they coincide." - "It is not a correct deduction from the principles of economics that enlightened self-interest always operates in the public interest. Nor is it true that self-interest generally is enlightened; more often individuals acting separately to promote their own ends are too ignorant or too weak to attain even these."

He describes how Laissez-faire in his time everywhere was presented as a untouchable scientific truth, on a par with Newton's laws and Darwin's theory of evolution. However, he points out that the big economists have never supported general laissez-faire, and the idea is not very scientific at all. The term basically comes from some topics of conversation that were popular in the Parisian cafe environment in the early nineteenth century.

Parisian cafe-life - painting by Gaetano de Las Heras - 1903.

For example, the father of economic liberalism, Adam Smith, supported a series of protectionist English laws called the "Navigation Acts", which required that all goods sent to England, Ireland or the English colonies should be transported on English ships, and that plantation owners and merchants in the colonies were only allowed to sell their goods to English merchants, or pay customs duties when they sold them to merchants of other countries.

Thomas Malthus supported the preservation of English import duties on grain from the Napoleonic era. Economic development had to be balanced between industrial development and the development of agriculture, he believed.

But, Keynes writes, it was first and foremost his contemporary economists who evoked the idea of laissez-faire: "But it was the economists who gave the notion a good scientific basis. Suppose that by the working of natural laws individuals pursuing their own interests with enlightenment in condition of freedom always tend to promote the general interest at the same time! Our philosophical difficulties are resolved-at least for the practical man, who can then concentrate his efforts on securing the necessary conditions of freedom. To the philosophical doctrine that the government has no right to interfere, and the divine that it has no need to interfere, there is added a scientific proof that its interference is inexpedient. This is the third current of thought, just discoverable in Adam Smith, who was ready in the main to allow the public good to rest on "the natural effort of every individual to better his own condition", but not fully and self-consciously developed until the nineteenth century begins. The principle of laissez-faire had arrived to harmonise individualism and socialism, and to make at one Hume's egoism with the greatest good of the greatest number. The political philosopher could retire in favour of the business man - for the latter could attain the philosopher's summum bonum by just pursuing his own private profit."

Southern Danish University. Keynes explicitly mentions the Universities as examples of possible "separate autonomies" - "between the individual and the modern state". But today, universities have "declared allegiance to a foreign prince" as John Locke would have said. Universities have declared the UN's 17 World Goals as their overarching goals. Foto Soerens Wikipedia.

He quotes a Professor Cairnes: "The doctrine of laissez-faire," he declared, "has no scientific basis whatsoever, it is at most a practical rule of thumb." And later: "The beauty and the simplicity of such a theory are so great that it is easy to forget that it follows not from the actual facts, but from an incomplete hypothesis introduced for the sake of simplicity."

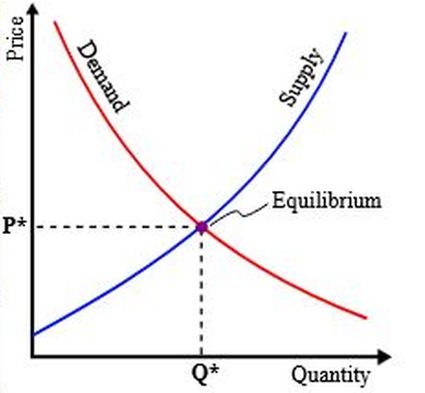

Which last remarks Keymes explains in more detail with the simple and beautiful curves of classical economics, which represent supply and demand that intersect at a balance point, are merely an educational presentation that covers a far more complicated reality. Which reflects his own description of a nation's economic life: "the economy of society is an unpredictable process characterized by instability".

The beautiful and simple model of supply and demand in the classical economy.

The classic economists, he says, designate a special case to be the normal and the rest to be regrettable complications: "For economists generally reserve for a later stage of their argument the complications."

He recommended that a government's intervention in the market must be extremely cautious and very well thought out. He quotes Burke and Bentham, who use the term "agenda" about the market problems that a government should solve administratively: We cannot therefore settle on abstract grounds, but must handle on its merits in detail, what Burke termed "one of the finest problems in legislation, namely, to determine what the State ought to take upon itself to direct by the public wisdom, and what it ought to leave, with as little interference as possible, to individual exertion." - "We have to discriminate between what Bentham, in his forgotten but useful nomenclature, used to term Agenda and Non-Agenda." - "Perhaps the chief task of economists at this hour is to distinguish afresh the agenda of government from the non-agenda, and the companion task of politics is to devise forms of government within a democracy which shall be capable of accomplishing the agenda"

Keynes illustrates his view of government intervention in the market with two "examples":

(1) He proposes to set up economic organizations of the "ideal size" - "between the individual and the modern State", which do not have long-term profit maximization as their overarching goal, but "whose criterion of action within their own field is solely the public good". - "I propose a return, it may be said, towards medieval conceptions of separate autonomies. But, in England at any rate, corporations are a mode of government which has never ceased to be important and is sympathetic to our institutions. It is easy to give examples, from what already exists, of separate autonomies which have attained or are approaching the mode I designate - the universities, the Bank of England, the Port of London Authority, even perhaps the railway companies."

The Blacksmidts' guild. Old drawing of unknown origin. The medieval artisan guilds and merchant guilds were not profit-maximizing organizations in the modern sense, nor were they unions. They worked in many ways for the benefit of their members by taking care of quality, tests of pieces of work for young persons finishing their apprenticeship and test for adults who wanted to be masters, pricing, and control of the number of practitioners in the profession. They supported the individual members in emergencies, for example if the house burned down, if they became ill or were threatened with death. The olderman swore allegiance to the king, making the guilds an important part of society. They created the framework for the lives of individuals with their ceremonies and annually recurring festive events.

The individual masters or merchants within the guild have certainly measured themselves against their comrades as it is men's nature. But a natural mutual rivalry was not allowed to destroy their organization and unity and damage their reputation.

In many places in Keynes' writing, it shines through that he wanted to create greater respect for the businessmen, whom he always called entrepreneurs and never capitalists. He believed that it was detrimental to capitalism - to which we really have no alternative - that its indispensable agents were perceived as fortune hunters and profiteers.

Besides universities, central banks, ports and railways, he is not very specific about what he means, but one can imagine that public utility companies would be something in the direction of his taste.

Moreover, he believed that many corporations of his time were gradually becoming public property, as they were already owned by a broad public: "But more interesting than these is the trend of joint stock institutions, when they have reached a certain age and size, to approximate to the status of public corporations rather than that of individualistic private enterprise."

(2) In what Keynes calls the second example, he again emphasizes the importance of agenda: "The most important Agenda of the State relate not to those activities which private individuals are already fulfilling, but to those functions which fall outside the sphere of the individual, to those decisions which are made by no one if the State does not make them. The important thing for government is not to do things which individuals are doing already, and to do them a little better or a little worse; but to do those things which at present are not done at all".

"We must take full advantage of the natural tendencies of the day, and we must probably prefer semi-autonomous corporations to organs of the central government for which ministers of State are directly responsible."he ends this "example."

Keynes would have welcomed the independent Danish GTS institutes as a means of improving the businessmen's decisions in the capitalist system, thereby increasing the national product and improving the system's agents, the businessmen's reputation.

Force Technology started as the Welding Central and today also offers solutions within materials, technical control and maritime technology. Bioneer A/S is an independent research-based service company within biomedicine, biomedical engineering and biotechnology. DBI is an independent, technological service company with securing life and values against fire as a core competence. The Alexandra Institute is a privately owned non-profit company that works with applied research in the field of IT innovation. The Danish Technological Institute develops and disseminates technological innovation to Danish industry. DFM A/S offers calibration and metrological advice at the highest international level. DHI offers solutions in water and the environment. Foto GTS-institutter.

He proposes the creation of some bodies to control currency and credit, as well as to collect and distribute information with with the purpose making the market more transparent and thereby more stable: " I believe that the cure for these things is partly to be sought in the deliberate control of the currency and of credit by a central institution, and partly in the collection and dissemination on a great scale of data relating to the business situation, including the full publicity, by law if necessary, of all business facts which it is useful to know." Which we must believe to a large extent has happened today with the now closed foreign exchange center, Denmarks National Bank, the Danish Banking Control, Statistics Denmark and the Danish GTS institutes.

But - despite his many picturesque words and explanations, we are still left with a big question mark: What is he talking about, does he want to abolish capitalism or what?

|

Left: Statoil's production platform on the Troll field. Statoil is a Norwegian public limited company, which is not directly subject to a minister's daily decisions, even though the state is the main shareholder. Statoil has been a dominant agent in the development of the Norwegian oil industry. The oil has been the cause of wealth in Norway not only because of the wealth that the oil itself represents, but also because the Norwegians have acquired and utilized all the technology that is associated with exploration and extraction of oil. Statoil has today changed its name to Equinor. Photo Offshore Energy Today.

Right: Lack of gasoline in Venezuela. Venezuela is one of the world's largest exporters of oil and has the world's largest documented oil reserves, but nonetheless, oil has had the exact opposite effect on Venezuela as it has had on Norway. The Chavez government nationalized the oil industry and used the state-owned oil company PDVSA to fund social programs - most of which consisted of direct cash payments to the demanding voters. Chavez's social policy resulted in an overconsumption that caused poverty, a shortage of everything in Venezuela and something as absurd as a shortage of petrol in March 2017 and regular famine in 2018. Photo: Wikimedia commons.

At the end of "End of Laissez-Faire" he says: "For my part I think that capitalism, wisely managed, can probably be made more efficient for attaining economic ends than any alternative system yet in sight, but that in itself it is in many ways extremely objectionable. Our problem is to work out a social organisation which shall be as efficient as possible without offending our notions of a satisfactory way of life."

Keynes was a staunch supporter of capitalism, which he believed we had no alternative to. But we can believe that his great concern was that capitalism has an Achilles heel, a built-in weak point, which in unfortunate circumstances can throw society into chaos and poverty, namely this "but that in itself it is in many ways extremely objectionable" which expression he apparently could not bring himself to explain.

He may very well have thought that a precondition for capitalism was a selfish and primitive struggle of all against all - deeply rooted in human nature - however, controlled and exploited by Western civilization - which in unfortunate circumstances could create resentment among idealistic voters in the Western world and motivate them to experiment with alternative economic systems, which on paper is based on good qualities of man, such as unity, cooperation and compassion for the poor and unfortunate, but which will ultimately "throw the whole population into a pit of poverty and death" as he puts it in "A Short View of Russia".

Many places in his authorship we can trace a wish to give the system's indispensable agents, the businessmen, respect, status and prestige - because we have no alternative to capitalism, and therefore it will in the long run be dangerous for Western civilization to perceive and describe them as primitive types, opportunists and knights of fortune.

"It is a mistake to think that businessmen are more immoral than politicians," he wrote in one of his open letters to President Roosevelt.

Inflation describes a deterioration of the value of money in the form of price increases. Deflation means an increase in the value of money that is manifested by a fall in prices.

Unemployed in thirties' USA. Photo Alphaville.

In "Social Consequences of Changes in the Value of Money" Keynes writes that any change in the value of money will be in favor of some and to disadvantage and misfortune to others, thereby creating the seeds of social dissatisfaction, turmoil and instability: "Thus a change in prices and rewards, as measured in money, generally affects different classes unequally, transfers wealth from one to another, bestows affluence here and embarrassment there, and redistributes Fortune's favours so as to frustrate design and disappoint expectation." - "Each process, inflation and deflation alike, has inflicted great injuries. Each has an effect in altering the distribution of wealth between different classes, inflation in this respect being the worse of the two. Each has also an effect in overstimulating or retarding the production of wealth, though here deflation is the more injurious."

Inflation in the Weimar Republic in Germany. Photo: Pinterest.

At inflation, savers, who have their fortune in a fixed amount of money, e.g. bonds, will see their life's savings reduced by the rate of inflation. Pensioners and others, who receive a fixed grant each month, will find that they can buy still less for it.

By contrast, the savers' counterparts, the debtors, who are all kinds of borrowers, will find that the real value of their debt will be reduced by inflation.

For businessmen, inflation will be beneficial, Keynes says: "But during the period of change, while prices are rising month by month, the businessman has a further and greater source of windfall. Whether he is a merchant or a manufacturer, he will generally buy before he sells" - "he is always selling at a better price than he expected and securing a windfall profit upon which he had not calculated. In such a period the business of trade becomes unduly easy. Any one who can borrow money and is not exceptionally unlucky must make a profit, which he may have done little to deserve. Thus, when prices are rising, the business man, who borrows money is able to repay the lender with what, in terms of real value, not only represents no interest, but is even less than the capital originally advanced."

He describes how the post-war inflation transformed formerly worthy businessmen into shameless profit-makers who "begins to think more of the large gains of the moment than of the lesser, but permanent, profits of normal business."

Politicians gave in effect the businessmen's greed the blame for the price increases by sending out extra taxes on profits, subsidies, price- and interest rate-stop. Photo: Cilgin kalaba likta nuzakta.

But by so doing, the businessmen incurred the anger and resentment of the other classes of society, as they understood that it was the greed of the businessmen that was the cause the price increases: "To the consumer the business man's exceptional profits appear as the cause (instead of the consequence) of the hated rise of prices."

But the European governments' money creation was the real reason for the inflation. Throughout the last years of the First World War, they had financed the war by printing money, thereby sowing the seeds for the significant inflation in the post-war years - not only in Germany. Nevertheless, they did not refrain from riding the wave and in effect blame the greed of businessmen for the price increases with a lot of subsidies, price and interest rate stops and extra taxes on profits. After all, they were politicians, and there were more votes in the consumers than there were in the businessmen.

In "Social Consequences of Changes in the Value of Money" Keynes is close to writing directly that the creation of money, the resulting inflation and the disturbances of the economy that it created in the form of reallocation of the wealth of society was the real reason for the emergence of socialism, which in turn caused the destruction of European culture and national communities that we still suffer from: "No man of spirit will consent to remain poor if he believes his betters to have gained their goods by lucky gambling. To convert the business man into the profiteer is to strike a blow at capitalism because it destroys the psychological equilibrium, which permits the perpetuance of unequal rewards. The economic doctrine of normal profits, vaguely apprehended by every one, is a necessary condition for the justification of capitalism. The business man is only tolerable so long as his gains can be held to bear some relation to what, roughly and in some sense, his activities have contributed to Society."

A businessman's windfall profit during inflation. Photo: Good Returns.

Also deflation creates a redistribution of the wealth of society, which is harmful to the stability of nations, since everyone, who have their fortune in the form of a fixed amount of money, for example in bonds or other debt securities, will find that their wealth is increasing: "Deflation, as we have already seen, involves a transference of wealth from the rest of the community to the rentier class and to all holders of titles to money; just as Inflation involves the opposite. In particular it involves a transference from all borrowers, that is to say from traders, manufacturers, and farmers, to lenders, from the active to the inactive."

As Keynes said, deflation will be especially harmful to society's productivity: "The deflation, which causes falling prices, means impoverishment to labour and to enterprise by leading entrepreneurs to restrict production, in their endeavour to avoid loss to themselves; and is therefore disastrous to employment. The counterparts are, of course, also true, - namely that deflation means injustice to borrowers, because they will find that their debt will increase."

The Great Depression, which started in 1929, and the associated massive unemployment put the focus on full employment as an important economic and political goal.

The classical economists believed that work is a goodie that is sold and bought in the market like other goods where there is supply and demand. As David Ricardo wrote in his famous article "The iron law of wages": "Labour, like all other things which are purchased and sold, and which may be increased or diminished in quantity, has its natural market price."

American unemployed about 1930. Photo Twitter.

Therefore, the economists believed that after some time the unemployed would adjust their wage expectations to the new conditions. Wages would gradually fall and more projects would eventually become profitable - until the market came back into balance and everyone got a job.

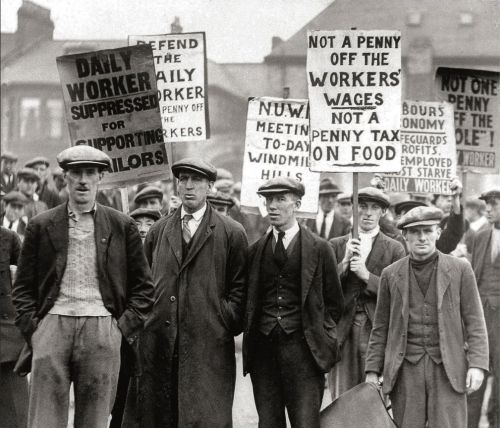

But Keynes noted that wages did not respond as the economists expected. They were were "sticky," and therefore the labour market would not come back to balance by itself. The workers would not accept such a large pay cut, and by virtue of the unions they had the strength to oppose it. Although millions were unemployed, there were still millions who still had jobs, and the unemployed could see that these were still receiving the original wages.

One cannot wait for the labor market to find a new equilibrium over time, he thought. "In the long run we are all dead", as he wrote to a friend. The classic economists came too easily to their conclusions. They only told that when the storm ceased, the ocean would be calm again; and what should seafarers use that for?

Quite different means were needed.

During the depression of the 1930's, classical economic theories were not able to explain the crisis and thus were not able to provide a solution on how to restore production and employment.

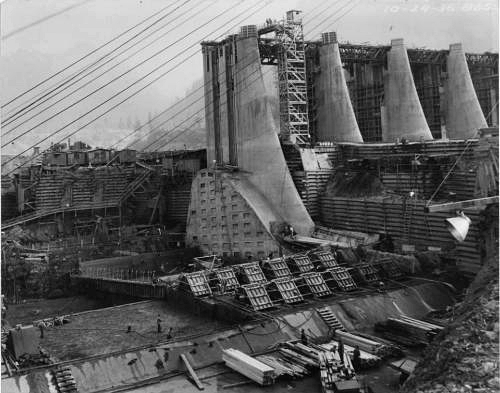

Public Works Administration Project Bonneville Dam under construction between the states of Oregon and Washington in the United States. Built 1934-1937. Photo U.S. National Archives and Records Administration Wikipedia.

They put their trust in the fact that the workers would give up and accept a pay cut, thereby many projects would become profitable again, the companies would again hire people and little by little this would restore full employment - but at a slightly lower level.

But Keynes argued that the labor market does not necessarily have any self-balancing mechanisms that automatically lead to a point of equilibrium with full employment. "There was no wage so low that it could eliminate unemployment," he wrote in "General Theory" in 1936.

As said - even though millions were unemployed, there were still millions who had jobs, and the unemployed could see that these were still receiving the original wages. Moreover, it was generally assumed that the businessmen had golden times. Therefore, they would not accept a large pay cut, and by virtue of their unions, they had the strength to oppose this.

Keynes 'solution to the problem was to stimulate the nations' overall demand by creating jobs and thereby giving the former unemployed money in the hands.

A nation's production of goods and services - and thus it's total demand and need for labor - stems from four components: consumption, investment, government procurement and net exports. Any increase in demand - and thus employment - must come from one of these four components.

|

Left: Franklin D. Roosevelt signs the law on the Tennessee Valey Project May 18, 1933.

Right: The construction of Douglas Dam which was part of the Tennessee Valley Project.

During a major depression, demand is dampened by households' inability to pay and their fear of the future. The low prospects for demand for companies' products are reducing investment. The reduced total income of citizens and companies in the form of wages or profits reduces tax payments and thus at first sight the opportunities for increased public procurement. Moreover, economic crises are rarely limited to a single nation, which will very likely mean that the rescue will not come from export earnings.

This Gordian knot Keynes suggested that governments cut through by simply printing or borrowing some money and introducing it into the nation's economy.

But he does not tell us much about how this stimulation of demand should take place in practice. In his "General Theory" he does not go into such details.

Opening of a new Autobanh in Germany in 1934. In Germany, the National Socialists came to power - also in 1933 - and the German financial genius, Economy Minister Schacht, quickly put an end to unemployment with a very similar expansive fiscal policy as the Keynes' recommended president Roosevelt in his open letter; That is, building autobahnen and the like.

He does not write unequivocally how this consumption of "borrowed or printed money" should be carried out; should goverment directly give the unemployed money in hand as a kind of unemployment support, or should the government start large public construction projects which created jobs and thus income?.

In an open letter in 1933 to US President Roosevelt, he compares the situation to a war, which is a very large public project, so we must believe that he did not intend to just give the unemployed some cash: "Thus as the prime mover in the first stage of the technique of recovery I lay overwhelming emphasis on the increase of national purchasing power resulting from governmental expenditure which is financed by loans and not by taxing present incomes." - "That is why a war has always caused intense industrial activity. In the past orthodox finance has regarded a war as the only legitimate excuse for creating employment by governmental expenditure. You, Mr President, having cast off such fetters, are free to engage in the interests of peace and prosperity the technique which hitherto has only been allowed to serve the purposes of war and destruction"

In the letter to the US President, he concluded that there is only one way to end the depression, namely by governments spending money that they do not have: "Broadly speaking, therefore, an increase of output cannot occur unless by the operation of one or other of three factors. (1) Individuals must be induced to spend more out of their existing incomes, (2) or the business world must be induced, either by increased confidence in the prospects or by a lower rate of interest, to create additional current incomes in the hands of their employees, which is what happens when either the working or the fixed capital of the country is being increased; (3) or public authority must be called in aid to create additional current incomes through the expenditure of borrowed or printed money" The latter is the crucial and controversial element in the theory of expansive fiscal policy.

Hoover Dam under construction on the border between Nevada and Arizona in the United States. It was built between 1931 and 1936. Photo Vibe Science.

An important element of the theory of expansive fiscal policy is the theory of the multiplier, which was originally proposed by Keynes' student, Richard Kahn, and named by Kenynes as the multiplier.

It describes that with expansive fiscal policy, a government can increase the national product by a value far greater than the "borrowed or printed money" that is "injected" into a nation's slowing economy. The inflow of this money is merely intended to be the impetus that sets the nation's economic wheels in motion by creating a chain reaction.

In connection with large construction works or the like, the state pays large sums for salaries, materials and subcontractors. This money gets into the hands of workers and contractors, who immediately use them for consumption, purchasing and investment. This in turn creates new income elsewhere in society, which is also converted into consumption, which in turn creates new income and so on.

Keynes writes in "General Theory": It follows that if the psychology of consumption in society is such that they will choose to consume, e.g. nine tenths of an increase in income, then the multiplier is k 10; and the total employment caused by (for example) increased public works will be ten times the primary employment; provided by the original public work, provided that there is no reduction in investment in other directions."

|

The Old Little Belt Bridge was built in 1925-1935, among other things, to create employment for the many unemployed. At that time, Denmark still had a national economy in the sense that one could expect that money paid for wages and most materials would largely be used in Denmark and thus help to make the wheels turning.

A similar expansive fiscal policy today would not have this effect to the same degree as we now have a globalized economy. It would set the wheels in motion, but in China, southern Europe, and similar places where the products come from. Even the bars we can not have for ourselves, some paid salaries would probably be spent on Mallorca and in Bangkok.

Photo: Villy Fink Isaksen, Wikimedia Commons, License cc-by-sa-3.0

In the United States, economist Mark Zandi has calculated the multipliers for different types of public consumption in modern times.

Federal support to states and spending on infrastructure have multipliers of 1.3 to 1.6. Expenditure on unemployment support and food stamps for the poorest, who are likely to consume all or almost all of an income increase, provide multipliers of 1.6 to 1.8. In contrast, tax cuts for high-income individuals and businesses provide the lowest multipliers - between 0.3 and 0.4 - as they are less likely to consume extra disposable income and more likely to save. But it is for the United States, which is a large country, where one can expect a large proportion of the consumption opportunities to be manufactured nationally.

In the 1930's, nations also had exports and imports as today, but to a much lesser extent. The economies of the nations were, so to speak, much more national. It was far more likely that newly hired workers would consume things that were manufactured within the country's borders, and therefore the multipliers of that time must have been much greater.

Today the situation is completely different. The economies of the nations are globalized. In a small globalized economy like Denmark, the vast majority of goods in the shops are manufactured in countries very far from the point of sale. Most utensils are produced in China or Vietnam, vegetables are from Southern Europe, software from the USA, cars from Germany and so on. An expansive fiscal policy in an economy like this will have very little effect, it will burn out like a wet firecracker, as the multiplier effect on the national economy will probably be negligible. It will boost the economy, but in China, Southern Europe and Silicon Valey and many other exotic places.

Helle Thorning Smith. In the election campaign for the parliamentary elections in Denmark in 2011, the Social Democratic candidate, Helle Thorning, repeatedly proposed an expansive fiscal policy "to make the wheels turning" despite that she should know that it would not have much effect in a small globalized economy like modern Denmark. No one opposed her. Photo Kathemera.gr.

But perhaps very large nations like the United States, China, and Russia can still benefit from an expansive fiscal policy.

It is a pervasive attitude of Keynes that he supports leadership and government and warns against laissez-faire in both economy, demographics and also in exchange rate policy. The gold standard represents a form of Laissez-faire policy, as the politicians want to lean back and let the free market forces in the gold market determine the value of a currency.

A treasure consisting of 159 Roman solidi gold coins was found at St Albans in

Hertfordshire in England in 2012. Photo Global Archaeology.

Ever since the severe inflation that followed the great war of 1914-18, ordinary citizens, who save for their retirement, have feared that their savings should be expropriated by inflation decided by central banks' boards. Especially in the US, many people look with suspicion on that currencies are managed by central banks' boards. The Austrian Economic School, represented by Ludwig von Mises and Friedrich Hayek, is very popular also in the US, precisely because it proposes a return to the gold standard, which means that the value of a monetary unit is defined by the market price of gold.

The gold standard is rooted in thousands of years of history, as many Roman and other historical coins consisted of gold. As coin material, gold was supplemented by other precious metals, especially silver and copper.

Especially the Germanic tribes, who attacked the Roman Empire around the year 500, had an insatiable desire for gold. Thus, archaeological findings from the older Germanic Iron Age in Scandinavia - describing the period from 375 to 550 - consist almost exclusively of objects of gold. Since there are no gold resources in the Scandinavian subsoil, we must think that this is gold that returning migration peoples have brought back to Scandinavia.

The Timboholm treasure from Vester Gotaland is a gold treasure from the migration age found in 1904 on Timboholm's estates on the outskirts of Skovde near Lidkobing by three farmworkers named Carl Wernlund, C. H. Lantz and Per Rython. It consists of two bars and 26 spiral rings of unprocessed gold with a total weight of 7 kg. It dates back to 400-500 AD. Photo: Historiska Varlder.

Gold has always appealed to human desires. Even after it has been buried in soil and gravel for thousands of years, it will preserve its golden shine. It is heavy and feels valuable to have in hand; Its low heat capacity makes it feel comfortable to touch. It is soft and easy to process into amazing jewelry. Psychologist Sigmund Freud believed that the desire for the golden metal originated deep in the mind of man, founded in the earliest childhood.

But precisely because people desire the precious metals so intensely, it was dangerous to keep one's assets in gold and silver at home. During the Middle Ages, rich citizens began to deposit their precious metals at jewelers, merchants, or others, who had facilities for safe storage. As a receipt, they could get a "Bank Note", for example, declaring the value "One pound sterling silver". In France, the Templars already in the 1200's ran banking activities from their castle in Paris, Les Temples.

It became more and more common that owners of the deposited silver and gold did not pick up their values, using "bank notes" for payments instead of the actual gold or silver. If the seller absolutely wanted gold or silver, he could just take his "bank note" and go to the bank and demand it delivered.

Dutch National Bank's gold reserves. Photo: The Event Chronicle.

The banks gradually found that it was relatively rare that someone presented their receipt and demanded the gold handed over. They could send more "bank notes" in circulation than they had in precious metals, and still be reasonably sure to be able to keep their promise of delivering gold or silver on demand. And this was the beginning of "managed" currencies.

The goal of the Austrian economic school is to return to the good old days when a monetary unit - dollar, pound or krone - represents a standard amount of gold stored in the currency issuing bank's basement.

Keynes has a number of concerns and arguments against a return to the Gold Standard.

Firstly, Keynes is - as always - an advocate of responsibility and management. A central bank's decisions should be governed by a currency policy that defines Stability of prices versus stability of exchange. "Is it more important that the value of a national currency should be stable in terms of purchasing power, or stable in terms of the currency of certain foreign countries?"

British bank note from 1843. Foto: British Notes.

Large nations may want to ensure a stable domestic purchasing power of their currency in relation to all other goods than gold.

But can we believe that the world market's gold supply will be constant - or just constantly growing - in all future? If the gold standard was introduced everywhere and suddenly new rich gold mines were found new places in the world, gold supply would increase and the price of gold would fall compared to other goods - along with the currencies, which would be inflation - and if the world's gold supply stagnates in relation to a rising national product, and the gold price therefore rises, it can lead to deflation.

If a single nation chooses to return to the gold standard, its central bank will be unable to maintain a particular exchange rate to the nation's important export markets. Its currency will be doomed to go up and down in alternating deflation and inflation following fluctuations on the international gold market. Any fluctuation in both directions will lead to losses and redistribution of the wealth of society and consequent political unrest followed by degradation of the common values of the nation. Government, politicians and central banks will wave their arms and say that this is completely natural market fluctuations and not their responsibility.

Queen Elizabeth inspects Bank of England's gold holdings. Photo Gold 401k.

Only if all the nations of the world change to the gold standard at the same time, fluctuations in the exchange rates can be avoided.

Secondly, he believes that gold is too rare to be an international reserve currency: "For except during rather brief intervals gold has been too scarce to serve the needs of the world's principal medium of currency. Gold is, and always has been, an extraordinarily scarce commodity. A modern liner could convey across the Atlantic in a single voyage all the gold which has been dredged or mined in seven thousand years. At intervals of five hundred or a thousand years, a new source of supply has been discovered the latter half of the nineteenth century was one of these epochs - and a temporary abundance has ensued. But as a rule, generally speaking, there has been not enough."

Thirdly, there is no efficient market characterized by perfect competition, which through thousands of transactions can define a stable price of gold and sustain our fascination with the golden metal. Few women wear gold jewelry, and very few men collect gold coins. The very most of the world's gold reserves have been melted into bars and put behind locks in the central banks' basements: "Thus, almost throughout the world, gold has been withdrawn from circulation. It no longer passes from hand to hand, and the touch of the metal has been taken away from men's greedy palms. The little household gods, who dwelt in purses and stockings and tin boxes, have been swallowed by a single golden image in each country, which lives underground and is not seen. Gold is out of sight -gone back again into the soil. But when gods are no longer seen in a yellow panoply walking the earth, we begin to rationalise them; and it is not long before there is nothing left."

|

An estimate of the real price of gold. It is seen that the price has been fairly stable for long periods of history also in the era of the classic gold standard, apart from some problems in the time of the French Revolution and the Napoleonic Wars. On the other hand, the fluctuations have been high in the 1900s. The graph shows only the gold price until 1998, but in the following 20 years, the fluctuations have also been big. Photo Zero Hedge.

The modern gold market is not a perfect competitive market, it may be better characterized as an oligopoly. Most of the gold is owned by a few central banks, who know each other and meet regularly.

Fourthly If a currency system based on the gold standard really was introduced, it would still be a "managed" currency. Central banks would not accept that their currencies followed a free gold market's unpredictable price fluctuations with all the problems it would imply for export companies, employees, consumers and traders. They would meet, probably somewhere in Switzerland, and negotiate how the cake should be cut.

Keynes did not reject the neo classical beautiful and simple interest rate model, which simply described the interest rate as the price of money created by the balance between savers' supply of loanable funds and the project makers' demand for funding. He improved and refined it.

The opening of the Storestrom bridge on a postcard. Photo: Lokalhistorisk arkiv for Nord Falster

Also for Keynes, the interest rate is determined by supply and demand for money.

The money supply comes mainly from the central bank's money supply. However, it may also come from, for example, income from a possible surplus on foreign trade and the like. The central bank can increase the amount of money by "printing" money and directly lending them to the banks or by buying bonds and other debt securities from the banks and paying them with "printed" money. It can reduce the amount of money by letting loans and debt securities to the banks expire and charge the outstanding amounts.

Following Keynes, the demand for money is determined by the income-motive, the business-motive, the precautionary-motive and the speculative-motive.

The income-motive is the desire to have cash enough to cope with daily payments.

The business-motive is explained by that almost all projects are characterized by that investments and costs come first, whereas the payments from sales only occur after some time. Companies want enough liquidity to bridge between these times.

The precautionary-motive is explained by that the future is uncertain and it is good to have funds to cope with unexpected situations.

The speculative-motive involves so to speak investing in cash. In uncertain times without significant inflation, cash is an excellent passive investment. If investors expect a fall in asset prices for example on shares, they will increase their cash reserves so they are ready to buy, when prices drop. Households and banks hold back their money, and that can drive up the price of money, the interest rate, if not the trend is met by the Central Bank by increasing the money supply.

John Maynard Keynes and socialist journalist Kingsley Martin photographed at Monk's house. Photo Harvard University Library Wikipedia Commons.

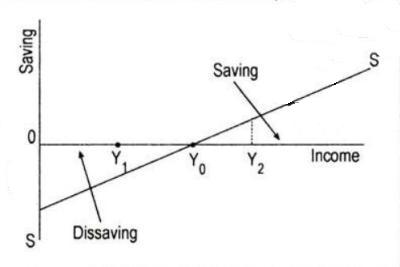

As said above, the classical economists thought that savings are a function of the interest rate, to be understood that a high interest rate will motivate individuals and companies to save more. Keynes, on the other hand, said that savings are a function of income rather than the interest rate, so to be understood that in a high-income economy individuals will save more than in a low-income economy.

This must support that the classical economists thought that human needs are infinite and insatiable, and he must have thought that the marginal needs of poor people are stronger than marginal needs of more wealthy people. So that more affluent individuals will tend to save a larger portion of their income at the expense of a marginal consumption.

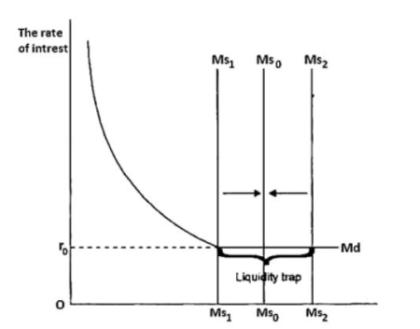

Keynes introduced the concept of the liquidity trap. This refers to a situation where an increase in money supply against expectations does not cause interest rates to fall; This may motivate a central bank to add even more liquidity to the market, which then also does not have the desired effect. The central bank can thus be said to have fallen into a trap and pumped out a lot of liquidity to no avail. One can imagine that the lack of effect may be due to the lack of sufficient potential business opportunities, consumers have already have covered basic needs and the like.

Liquidity trap - The vertical axis represents the interest rate and the horizontal the amount of money. It can be seen that if Ms0 is reduced to Ms1 or increased to Ms2, the interest rates will remain unaffected. Drawing from economicsdiscussion.net.

For many years the theory of liquidity trap was standing in the shadow of other economic theories but it emerged from the scenes, when Japan experienced a prolonged stagnation period in spite of an interest rate level of 0%. Following the financial crisis in 2008, Japan was joined in the liquidity trap by the United States and Europe. Economist and Nobel Prize winner Krugman noted that a tripling of the US money supply from 2008 to 2011 had no significant effect on US interest rates and consumer prices.

It fits very well with Keynes's advice to President Roosevelt in his open letter in 1932: "Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt."

Keynes had an idea of what the interest rate should be. In General Theory, he argues for a low level: "It is thus in our best interest to reduce interest rates to the point in relation to the projected marginal efficiency of capital where there is full employment."

"There can be no doubt that this criterion will lead to a much lower interest rate than has hitherto been the case; and, as far as one can guess from the schemes of the marginal efficiency of capital corresponding to increasing amounts of capital, it is likely to fall steadily should it be practicable posible to maintain conditions for more or less continuous full employment. "

A low interest rate would become a problem for the rentier class, which was part of the upper class in the England of that time, who lived on a risk-free interest return on their fortunes and otherwise did nothing useful or productive. But Keynes shed dry tears over this because he believed that this class was being rewarded for overt vacancy and it was a problem for the general acceptance of the capitalism to which we have no alternative.

He never mentioned the businessmen in such a negative way. He always called them entrepreneurs and never capitalists.

The "Quantity theory of money" states that there is a connection between money supply and price level and output. So that if the money supply increases then the price level and output will also increase and if the money supply decreases the price level and output will also decrease.

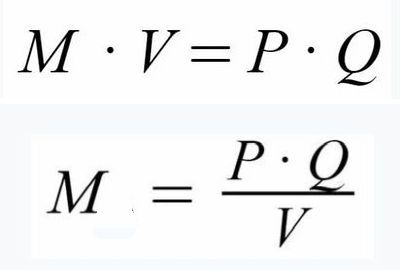

The classic quantity theory of money. M = money supply, V = money turnover rate, P = price level, Q = GDP (output). Foto ebrary.net.

The theory of quantity of money was the cornerstone of the economic theoretical direction called monetarism. Economist Milton Friedman was a leading advocate for this direction. He believed that central banks could control price levels and output by increasing or decreasing the money supply - at the same time he was known for his support for laissez-faire capitalism. The idea was that when the central banks could control economic activity indirectly through the money supply, all other interventions in the market were unnecessary, even downright harmful.

Mises, Hayek, and other Austrian economists supported the Quantity Theory of Money, only emphasizing that by increasing the money supply, some individuals will come into possession of this money before others, and prices of some commodities will rise before prices of other commodities. Their many attacks on central banks to blindly manipulate the money supply and thereby inadvertently create economic crises show that they consider it self-evident that there is a causal link between money supply, price levels and activity.

Keynes stated that prices are primarily determined by production costs. He believes that changes in the amount of money do not affect the price level directly, but indirectly through the interest rate and the resulting level of investment, profit, production and employment. He also did not believe that the price level rises in direct proportion to the money supply.

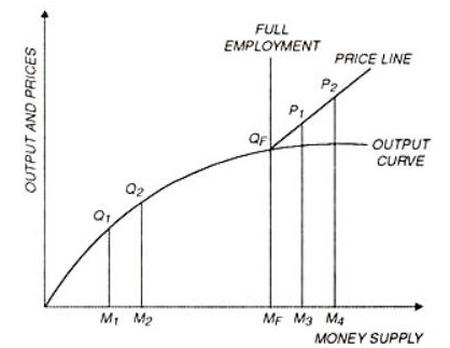

Keynes' version of the quantity theory of money. If the money supply in a situation with vacant capacity increases from M1 to M2, output will increase from Q1 to Q2, while the price level will not be affected - because new employees are hired for the same or less pay, and investments do not have an effect so quickly. Only when the money supply reaches Mf and output reaches Qf - ie at full employment - does the price level begin to move. An increase in the money supply during full employment from M3 to M4 will increase the price from P1 to P2 - because workers and subcontractors are now in a situation where they can demand wage increases and higher prices - but it will not affect output significantly. From Economics Discussion.

As mentioned above - In his open letter to President Roosevelt, he did not have much left for the theory of quantity - at least in the short term: "The other set of fallacies, of which I fear the influence, arises out of a crude economic doctrine commonly known as the Quantity Theory of Money. Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States to-day your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money, which is only a limiting factor, rather than the volume of expenditure, which is the operative factor."

Say's law was one of the targets of Keynes' criticism. It is for classical economists what Newton's laws are for physicists. It is one of the most important theories in support of the laissez-faire idea that a capitalist economy is basically in balance, as without government intervention it will have a natural tendency towards stability, prosperity and full employment.

Jean-Baptiste Say 1787-1832. He was born in Lyon, France. He worked in England until 1786, when he was employed by a life insurance company in Paris. He was 22 years old, when he experienced the French Revolution. He got into trouble with Napoleon in 1804 and set up a textile factory in Calais. He wrote a number of books on economics and freedom of the press. Foto Wikipedia.

The law says that "Once a product is created, it will from that moment create a market for other products of the same size as its own value;" which is usually expressed: "supply creates its own demand ". It should be understood such that when a businessman produces and sells a product or service on the market, he will receive sales revenue that he will immediately use to demand other goods and services that he believes he needs - privately or for new business. His supply is thus immediately converted into a demand of the same size as his supply.

The wording sounds a bit cryptic but the point is that a businessman will only keep the liquidity that seems to him strictly necessary - as illustrated by the economic textbooks' liquidity analyzes. For the rest of the money, he will immediately buy materials, goods or the like, which he believes can be beneficial in the future, thereby creating demand for other businessmen's products.

Among the classical economists, Say's law is assumed to keep the economy of society in perfect balance, as long as government does not interfere. Foto Craig Wright.

Since the entire market's supply and demand is the sum of all agents' supply and demand, the total supply and the total demand will therefore be exactly equal. Thus, according to Say's law, there can never be a general overproduction - that is, a situation where society's total supply is greater than the total demand, a general "bubble".

Some believe that Say's law states that "human needs are infinite and insatiable" . Say has not commented on that, probably because he considered it self-evident. The insatiable human needs are a tacit precondition for Says Law, as the businessman above will not be motivated to use the liquidity he has earned if his needs are not strong enough or if there are no promising business opportunities created by needs. < br>

For the classic economists, savings are a function of interest rates, so a high interest rate motivate individuals to save. For Keynes, saving was a function of income, so that individuals with high incomes, all other things being equal, will save more than people with low incomes. Which means that a society with a high income level will save more than a society with a low income level - and of course vice versa so that individuals with a low income will consume a larger part of their income. Which suggests that he did not mean that human needs are unconditionally infinite and insatiable. From Economics Discussion.

Keynes did not directly deny the classic thesis that "human needs are infinite and insatiable" , but in his mention of interest he writes that savings are a function of income - and not of interest - so that individuals with high income everything else being equal will save more than people with low income. Which indicates that the intensity of marginal needs is decreasing with increasing income.

Keynes pointed out in "General Theory" another tacit precondition for Say's law, which is seldom fulfilled: "Say implicitly assumed that the economic system always operated at its full capacity, so that a new activity always substituted and never supplemented another. Almost all subsequent economic theory has relied on the same assumption in the sense that it has required the same assumption, but a theory based on such assumptions is clearly incompetent to solve the problems of unemployment and the business cycle."

Unlike Say, Keynes emphasized the importance of speculative demand for money.

The speculative motive involves investing in a cash holding. In uncertain times without significant inflation and with low or negative interest rates, cash is an excellent passive investment, better than bonds with negative interest rates. If businessmen expect a price or price drop, they will increase their cash holdings so they are ready to buy when the price drops.

Disney's Joakim von And. In uncertain times of low or negative interest rates, cash can be an excellent passive investment, pulling the rug away under Say's Law

But the speculative motive for holding liquidity places a bomb under Says Law, which presupposes that agents' revenues from their sales - their supply - immediately return to the market as demand, thereby maintaining the balance between supply and demand - and thus the stability of the whole economy.

Nowadays, a businessman in many cases does not want to maintain an actual traditional liquidity, he may want to buy shares for the money - which are also quite liquid.

Keynes' major work, The General Theory of Employment, Interest, and Money, was published in 1936 and was to become the textbook of several generations of economists and politicians around the world.

Unemployed queuing in front of New York Relief Office 1929. Photo Wikimedia Commons.

Most of his early articles and speeches from the twenties and early thirties are all contained in "The General Theory" - including the critique of classical economics and his arguments for a "new liberalism" as well as his arguments for a government's "deficit-spending" as an effective means of overcoming very serious crises such as the Great Depression of the 1930's.

By the term "General Theory" is meant that Keynes believed that all previous economists including Adam Smith, Jean-Baptiste Say, David Ricardo, Thomas Malthus, John Stuart Mill and perhaps Karl Marx in his opinion merely described special cases in economics, while his book describes the economy as a whole.

In the first chapter of "General Theory" he writes: "I have called this book the General Theory of Employment, Interest and Money, placing the emphasis on the prefix general. The object of such a title is to contrast the character of my arguments and conclusions with those of the classical theory of the subject, upon which I was brought up and which dominates the economic thought, both practical and theoretical, of the governing and academic classes of this generation, as it has for a hundred years past. I shall argue that the postulates of the classical theory are applicable to a special case only and not to the general case, the situation which it assumes being a limiting point of the possible positions of equilibrium. Moreover, the characteristics of the special case assumed by the classical theory happen not to be those of the economic society in which we actually live, with the result that its teaching is misleading and disastrous if we attempt to apply it to the facts of experience."

The General Theory of Employment, Interest, and Money. Photo Heritage Auctions.

The classical economists described how the curves of labor supply and demand intersected, thereby forming an equilibrium point that would surely occur in the long run because workers and contractors would adjust the price of labor after each other.

But Keynes argued that classical theories often assumed full employment or full capacity utilization, and therefore they could not be used to solve the real economic crises, which were precisely characterized by widespread unemployment and unused capacity.

Classical economists - including Marx - saw inescapable economic laws everywhere, while Keynes wrote that "the economy of society is an unpredictable process characterized by instability".

In 1933 Keynes published a controversial article in The Yale Review, advocating a greater degree of national self-sufficiency, and - logically speaking - thus a lesser degree of international trade. This for an economist's heretical point of view is often referred to as protectionism. His goal was to bring the unemployed to work and utilize the country's resources by producing products that England otherwise imported from abroad.

This was a sensational break with hundreds of years of English free trade tradition introduced by Adam Smith and David Ricardo.

|

The closed Thomas B. Thriges factories in Odense Denmark has now been transformed into second-hand stores, oriental markets, public offices, meeting rooms and much more. Thomas B. Thrige produced electric motors, elevators and equipment for power plants.

The old European factories, which produced a wide range of products in their respective areas have largely been closed and only partially replaced by much more specialized companies, which are better suited to today's globalized economy. Photo Google Maps.

Adam Smith wrote in 1776 in the "Wealth of Nations": "If a foreign nation can provide us with a commodity cheaper, than we can make it ourselves, then it is better to buy it with a part of our own production, in which we have some advantage."

David Ricardo in 1817 put forward the famous example of cloth produced cheaply in England, and port wine produced cheaply in Portugal. He described Portugal exporting port wine to England, and England selling clothes to Portugal. This international trade is mutually beneficial, as both nations become richer than they would have been if the Portuguese had drunk all the port wine themselves, and the Englishmen had kept their cloth.

The long time since closed Brandts Cloth Factory in Odense Denmark. There is now cultural center, cinema, cafes, meeting rooms, art school, film workshop and much more in the building. Photo: Marco Kahlund Wikipedia.

Keynes also had the wealth of England in mind. He knew that the value of labor, which is not utilized, is lost forever when the day is over. England should, to a greater extent, produce itself instead of importing from distant countries. He wrote: "Even today I spend my time" - "in trying to persuade my countrymen that the nation as a whole will assuredly be richer if unemployed men and machines are used to build much-needed houses than if they are supported in idleness."

"If I had the power today," he wrote, "I should most deliberately set out to endow our capital cities with all the appurtenances of art and civilization on the highest standards" - "For with what we have spent on the dole in England since the war we could have made our cities the greatest works of man in the world."

All in all, he did not think that the benefits of international division of labor were as great as they had been: "But I am not persuaded that the economic advantages of the international division of labor today are at all comparable with what they were." - "But over an increasingly wide range of industrial products, and perhaps of agricultural products also, I have become doubtful whether the economic loss of national self-sufficiency is great enough to outweigh the other advantages of gradually bringing the product and the consumer within the ambit of the same national, economic, and financial organization. Experience accumulates to prove that most modem processes of mass production can be performed in most countries and climates with almost equal efficiency."

The Italian aircraft manufacturer Officine Meccaniche Reggiane between Parma and Bologna is closed and the premises converted to alternative use. Photo: The Architecture Insight.

His concerns about excessive international division of labor were in line with the efforts that simultaneously were unfolded in the United States and Germany to get rid of unemployment. In these countries, they did not come out of the thirties' crisis by increasing international division of labor, but by boosting domestic demand and supply, just as Keynes had in mind.