|

Home DH-debate |

In the late eighteenth and early nineteenth century developed in England a very special set of ideas on political economy, which was called economic liberalism.

The English civil war.

Although it had grown out of England's special history, its supporters claimed that it was a universal theory valid for all human societies.

Basically, the English economic liberalism came from the political climate that was created by the English Civil War and the settlement between the king and the parliament.

In a similar way as Newton had discovered the universal laws that controlled planetary movements, uncovered Adam Smith, Ricardo, Bentham, Mill and their contemporaries the eternal and universal economic laws that govern a harmonious human society.

The liberal tradition is supported by three pillars, which are individual freedom, the eternal and immutable economic laws and the idea of harmonious balance between opposing economic forces. Just as in Newton's eternal and immutable laws of physics, where the gravitation force and the centripetal force keep each other in check, thus also the economic forces of supply and demand keep each other in balance.

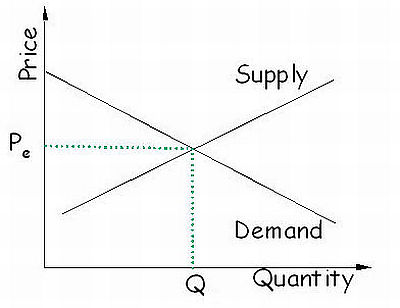

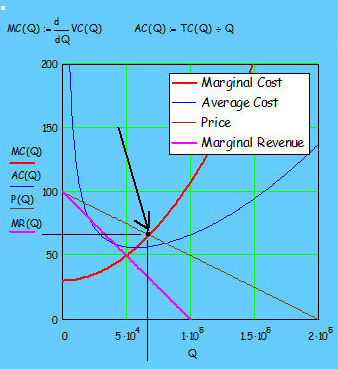

The free market is often symbolized by the familiar graph where supply and demand intersect, forming the market price.

The traditional representation of supply and demand.

The quantity provides the horizontal axis and the possible prices are indicated on the vertical axis. The decreasing demand curve intersects the increasing supply curve, thus creating the stable market price.

As society's economy is the sum of such stable submarkets, the whole economy is also stable, the liberal theory says.

The problem with this representation is simply that it only fits in the short run in special cases. Everyone knows that the vast majority consumer goods in the long run become cheaper, not more expensive, the larger quantities are produced and marketed. This applies to flat screen televisions, computers, cell phones, solar cells, tents, yes to all products for manufactured goods market and on the market for machinery and production equipment. Therefore it is wrong to assume that the graph of the supply price generally is increasing.

It is also quite well known that demand and supply are not two independent functions as the liberal tradition defines them. The modern demand is in very high degree a function of the producing firms marketing.

|

Flat screen television, Sun cells and Mobile phone.

The classical economists tell us that an economy, where each agent is completely free to follow his own interest, spontaneously will create an optimal distribution of society's resources. Any interference in the market from the state will most likely prove disadvantageous in the end, they say.

Thus liberalism ascribes the businessmen and their firm's freedom to follow their self-interest and take their own decisions on the market as long as they are not cheating, stealing or committing other criminal acts. It will in most cases also be the most appropriate, but we do not have to elevate it to a law of nature.

In a liberal society, the top executive, the political leader, is not entitled to issue a vertical order to a specific company. For example, a king or a government cannot just command some specific Danish companies to establish branches in les developed areas in the same way as a military high command can issue a vertical order to certain generals about taking action.

|

Left: King Erik VIII Menved, who arrested archbishop Jens Grand.

Right: The leaders of the Templars being burned on the stake.

Only in few and short periods of history, we have previously seen that important society organizations thus have been granted freedom and in this way evaded the kings and the executive powers direct authority for a longer time.

The medieval struggle between the king and the church were for example just about that; the church sought to evade the secular power. The Danish king Erik VIII Menved arrested in 1294 Archbishop Jens Grand for treason and threw him in a gloomy dungeon under Soborg Castle.

King Philip the Fair of France dissolved and ruined the order of the Templars in France in 1307, the leaders of the order were burned on the stake.

Queen Margrethe 1. of Denmark.

Margrethe 1. of Denmark waged war against the Hanseatic League.

King Philip and Queen Margrethe were neither socialists or communists, also they were not supporters of planned economy.

They did it because they were the ones who had power and thus the ultimate responsibility for the country and its people's future, and therefore they could not tolerate such multinational millipedes with a foot in every country, which only worked for their own purposes and in their own interest.

Liberalism also assumes that what is rational and beneficial for the individual producer and consumer, is also rational and beneficial to the whole economy if everyone does it.

Precisely at this time a lot of companies take decisions to shut down their productions in Denmark in favor of Asia, or not start them, because it gives a bigger number on the bottom line for their respective companies. However, when everyone does it, it will cause that a big part of production activities in Denmark, yes all over Europe, will be closed and our countries will no longer belong to the group of industrialized nations. And it can not be said to be good for the whole economy.

One need not be in favor of a revolutionary -ism to appreciate one's own people and country and desire to support them.

A van from Dan Electric

There are many, also in the private business sector, I think, that would like to do something for their country. One can only drive along on the highway noticing firm names on the vans. They belong to such firms as Dan-Electric, Dan-Property, Dan-varnish, Dan-insulation, etc., not to mention Dan-foss. Just try to make an entry in the database "Krak firm" and search for Dan-. The companies are probably named so because their original owners and first entrepreneurs saw themselves as good Danish men, who wanted to make their contribution to their country's prosperity and development. When the late Queen Ingrid years since mentioned the unemployment problem in South Jutland to Mr. Moeller from Maersk, he took immediate steps to create a container factory in the province.

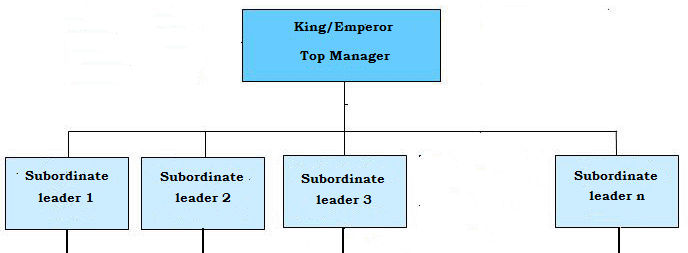

In far most time of civilization history the nations have been organized so that the ruler, it will usually mean the king, had assigned tasks to his men. Some became responsible for defending the border, others were responsible for this or that province, and so on. Of course, the trusted men had to do the job based on their own assessment and their own decisions. But they were not completely independent, the ruler always watched them over their shoulders, and a vertical order from the highest office always had to be obeyed.

|

Traditional organization through all history.

Thus, the Roman emperors governed their provinces and legions, and so have the Chinese dynasties ruled their vast empires. In the Middle Ages, artisan- and merchant-guilds were headed by aldermen, who ultimately referred to the King. Throughout the long history of civilizations, it has rarely been the case that important parts of the community body could claim "freedom".

The traditional organization is still the basic principle of military organization and the internal organization of private firms. The tasks are delegated to the subordinate managers, who must solve them as best they can, except that top executives are looking them over their shoulders and can issue a vertical order, if he deems it necessary.

The main role of the classical economy today is to legitimate the big business organizations' freedom and independence of the power of the state. It has no practical use. You will not get very far by trying to use the classic diagram of the rising supply and falling demand for product pricing or use the marginal principle or the like for production planning.

If the classical economy falls, then the big business organizations can only justify their demand for freedom by saying that it has been usual for a few hundred years.

University lesson in classical economy.

John Maynard Keynes showed that instability is an intrinsic characteristic of the market and that there is no guarantee that it by itself finds a state or just touch a point, which implies full employment while ensuring the best utilization of resources. His works represent a dividing line between nineteenth-century's economic philosophy and twentieth-century's in the same way as Einstein's contributions to physics represented a new fase. Keynes rejected the old world economic natural laws that describe how the economic forces by themselves pull the economy towards equilibrium with a gravitation like force, as Newton had described the cause of celestial movements.

Keynes replaced the traditional economy with a more modern and more likely view that the economy is a dynamic process characterized by instability and uncertainty, which cannot be completely and unconditionally left to itself and the businessmen.

Such a perception, real or not, cannot be accepted by the large international firms and thus not by the universities. If one imagines that a university placed the classical economics in a corner, its graduates would be labeled as "red", and they would find it difficult to get jobs. This would again cause that such a university would have difficulty attracting qualified students, which in turn would cause that the level would fall, further more, it will be difficult for candidates to find good jobs. A rejection of the classical economy would inevitably initiate the beginning of a downward spiral that would imply still more inferior scientific status and decreasing revenue.

The logo of the JAK association

Adam Smith introduced the three resources, which are the celebrated - Land, Labor and Capital.

Land means farmland, forest and all sorts of minerals, at all natural resources. Labor is to understand the impact of the human effort. Kapital is factories, ships, buildings, roads, machines, at all production assets.

Prices of the three types of resources are determined on their respective markets, various markets for raw materials, the labor market and the markets for machinery etc.

Since all resources are considered scarce, the possible prices

as a function of the possible supplied quantities will be inclining. The possible prices as of a function of the possibly demanded quantity will, on the other hand, be declining. Where the curves for respectively supply and demand intersect, the market price defines.

The market price represents an economic equilibrium, where supply equals demand. Since the supply and demand function in the classical economics always have different slopes, it is a stable equilibrium. Any discrepancy in prices or quantities will be driven back towards equilibrium by the increased spacing between supply and demand, as a pendulum that little by little will find rest in vertical position.

|

Left: The traditional concept of a capitalist.

Right: The traditional concept of a consumer.

Since the whole community's economy in the liberal theory is the sum of such stable partial markets, the total society has also a stable economy.

The capitalists and the consumers are the primary agents of the game.

Capitalists are such persons, who own capital, i.e. production plants and machinery. They demand for raw materials, labor and capital goods, also called capacity. They are able to bring together the three cost-types, raw materials, wages and capacity costs in different combinations so that the result will be finished products, which are introduced on the market for end-products, where they are in demand of the consumers.

The consumer is the game master, swinging his conductor's stick. It is the consumers endless and insatiable need for goodies that makes the whole system work.

What father does is always right

The consumers have desires and needs far beyond, what their restricted budget allows, therefore, they are assumed to be in the position in a rational way to select which objects that best satisfy their individual wishes. In the liberal theory, the agents are imagined to shop around on the market selling, buying and swapping until they all are satisfied, what each has achieved. Maybe something like the father in H.C. Andersen fairy tale "What father does is always right ", he goes out with a horse and swap and trades numerous times until he comes home with a sack of rotten apples. Nevertheless, he gets a kiss from his wife for his achievement, and everyone is happy.

Supply and demand are supposed to be two independent functions. It is assumed that before consumers and the capitalists enter the marketplace from either side, they have in a rational way made themselves entirely clear what needs, they have, and in what sequence, they will satisfy them.

Demand and supply curves are cross sections in time. The alternate quantities are such which now are believed and imagined that consumers would buy if the prices was such and so, or the prices that the capitalists could currently achieve if the marketed quantities were such and so.

The companies are assumed to be profit-maximizing. As consumers, they are supposed to act marginally. Some planned additional units might be expected to cause a larger marginal increase in costs than they would cause in increase of revenue, and therefore the companies will choose not to produce them. Alternately, a possible increase of their production is budgeted to give rise to a larger marginal increase in revenue than marginal increase in cost, and therefore they will choose to produce it.

The increasing marginal cost curve intersects the declining demand curve.

All production companies are assumed to be characterized by declining profits as a function of the volume of production. It is assumed that when the production volume is approaching capacity limits, the production cost will become bigger and bigger for each marginal unit produced. This is because of overtime work, increased maintenance, shift, newly recruited and inexperienced workers, etc., it is said.

The golden rule of Profit maximization requires companies to expand production unit by unit until the cost of the last unit produced is equal to revenue for this very same last unit. It can only be done by increasing supply curve, but this is always the case in the classical economy.

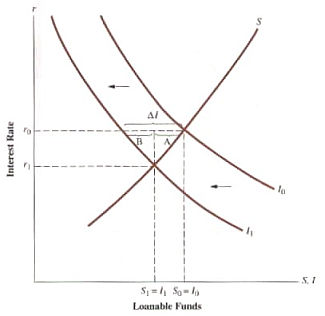

In the money market funds are offered by savers, the higher the interest rate the more inclined they are to save, and the greater the availability of money. Therefore, the supply curve is rising. For the businessmen, or shall we say the capitalists, it is the opposite. The higher the rate the less likely they will want to borrow money and launch projects. Therefore, the demand curve is sloping downward.

Raw material markets, labor market, the market for production equipment, finished goods market and money market are all like interconnected vessels. They make up a sensitive regulatory system that automatically adjusts the economy to the optimal allocation of resources after an exogenous disturbance.

Cross-elasticity in the classical economy.

A change in one market will quickly spill over to all other

places in the system. For example, an increase of prices in the commodity markets will cause prices on the market for manufactured goods to increase, so will the produced volume decrease, the price of a working hour will also fall because workers no longer can sell so many man-hours to the high price. Therefore they will lower their salary and in this way try to get back on the market, says the classical theory.

All goods have more or less close substitutes and complements. The classic examples of substitutes are butter and margarine and petroleum and gas (for heating). For example, an increase of the price of butter will increase the demand for margarine; in commodity markets an increase of the price of aluminium will cause some producers to replace aluminum with plastic or steel and thus increase demand for these materials.

Complements are something that belongs together, like beer and snacks.

In total, the theoretical market system can be compared with a complicated technical regulation system in which each unit in the system exchange hydraulic pressure or

electrical voltage. However, in the classical economics it is information on prices, which are exchanged. It is why textbooks in classical economics are often called price theory.

Classical economics is a very beautiful and wonderful simple theory. All that is needed is that we indulge ourselves with our selfish ego and follow our own self-interest. Magically - without any intervention or control from the authorities - it will allocate all society's resources to their most effective use, for the benefit of the whole community.

|

|

Friedrich List was born in Wurttemberg in current Germany, in 1789, the year of the French Revolution. In 1817 he was appointed a professor of management and policy in the University of Thuringen.

Friedrich List, 1789-1846

However in connection with some political turmoil, he was

in 1822 dismissed and sentenced to 10 months of hard work in the fortress of Asberg. He escaped to Alsace, spent some time in France and England, and returned back to Wurtenberg in 1824 to endure the rest of his punishment. He was released on condition that he would emigrate to America.

He showed up in the U.S. in 1825 with an introductory letter from La Fayette. He was introduced to President Jackson. In the U.S. he earned his living as a farmer and journalist; he edited a German-language newspaper in the city of Harrisburg in the state Pennsylvania.

In 1832 he was appointed as an American consul in Leipzig.

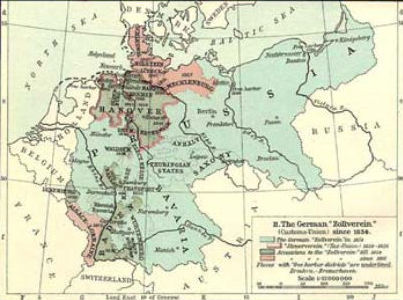

He was the intellectual driving force in establishing the Common-German Zollverein, which was established for a large part thanks to his enthusiasm and vigor. He was a great proponent of the expansion of the German railway system.

In 1841 he was offered a position as editor of a newly established liberal newspaper in Cologne named "Rheinische Zeitung". However, he declined the offer on grounds of poor health. The position was instead given to the young Karl Marx.

In the last years of his life he suffered from a fatal and very painful disease, and the 30. of October 1846, he chose to take his own life at the age of 56.

|

|

List had no great thoughts about the classical economics. The purpose of the English liberalism was clear, he argued. "The monopolizing islanders," he wrote in 1841, "has reduced the Germans to hewers of wood and drawers of water for Great Britain."

The British argument that free trade is a universal good, was nothing less than hypocrisy: "Any nation which by means of protective tariffs and trade restrictions has increased its productive power and its marketing to such a degree of development that no other nation can sustain free competition with it, can do nothing wiser than to throw these ladders away, which led to its greatness, to preach the benefits of free trade to other nations, and in penitent tone, declaring that they have hitherto wandered in the paths of error, and that they now for the first time have managed to discover the truth."

The subtle nuances in the debate Smith contra Ricardo were totally wasted on List. To him, they were simply "the British school," which, regardless of how they expressed it, was merely a tool disguised as an economic system that supported British domination.

The German Zollverrein.

Friedrich List was the driving intellectual force in creating the German "Zollverein". He argued that the correct rate of custom tariff was about 60%, which gradualy should be lowered to 30%. He was opposed subsidizing exports since he believed that money could be better spent on developing new projects than to attack markets where the competitors already had a solid foothold. His recommended strategy was that the state should create conditions for the production activity and then leave the rest to the private initiative - despite his emphasis on the role of government, he had no ideas about planning economy.

He made fun of Adam Smith's "confusion" that he called Smiths various value-price terms, the "natural price", "market price" and so on. He attacked Smith's pin factory. The important thing was essentially not the division of labor, he wrote, but the important fact is that the workers are united in cooperation in the production. A pin factory would never be created by the market forces alone. It does need mines and mills, which can deliver steel. It needs transport roads and rails to supply the raw material and to distributing of finished goods. It needs numerous retail stores to distribute its products. It needs experienced workers to operate the machinery and skilled engineers to design the engines. It needs an organized society, law and order and a stable currency. All this must be created and launched by a general organization, namely the state. To claim that such a plant can grow out of the market by itself is entirely speculative, said List.

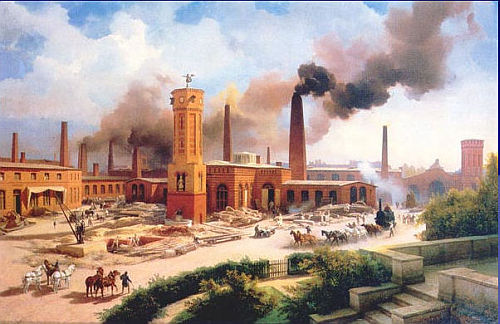

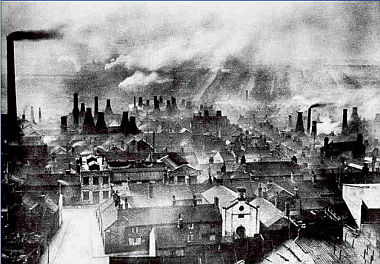

German factory 1840.

Every community that has developed its trade and industry, has done it supported by the state, wrote List. Whether it was the Hanseatic city-states, the Netherland, the Republic of Venice, the Portuguese or the Spanish. To deny that the state plays a role in "The Wealth of Nations" is to play games with the facts.

There is one important difference between the classical economists and Friedrich List. The liberal economists speak of increased "wealth", i.e. riches as the overall objective of the economy. Production plants are to them merely means to create that wealth. However, Friedrich List wrote: "The productive power to produce wealth is immensely more important than wealth itself. It ensures not only the possession and increase of what had been gained but also compensation for what has been lost."

In modern times, many business owners are busy closing down Danish production plants, yes, business leaders across Europe dismantle their production lines and move the production to Asia. They do this because it will increase their expected income, the bottom line, thus increasing their "wealth". They could learn something from List, "The productive power of producing wealth is immensely more important than the wealth itself."

Friederich List has been criticized for not having anything to offer except for the nowadays so despised protectionism. He has not drawn any sophisticated curves and set up equations, which describes and predicts the economy and the market as a function of this and that.

That might be because he believed that the economy is created by human decisions more than it is decided by economic laws of nature. Shall we say the Volkswagen factories development, just to take an example, are also not determined by eternal economic laws appearing in various equations, but by decisions of the management.

Karl Marx

We must recognize that Marxism is a variant of economic liberalism. Karl Marx was one of the classical economists.

If we reject or downgrade the classical liberal economics, we must by logical necessity also reject Marxism.

Karl Marx sat in London and studied the classical economists, Smith, Malthus and Ricardo in particular. He accepted all the classical economics ideas and concepts. The idea of eternal and immutable economic laws governing society's economy, concepts like supply and demand, equilibrium, market price and the variety of price and value definitions.

He did, however, give the liberal theory a twist toward that the economic laws were such that they were predestined to destroy the capitalistic economy after a certain time. In the ensuing chaos, a revolutionary and decisive working class would have their chance.

If it is true that the economy is controlled more by human decisions than it is controlled by the eternal economic laws, then Marxism's idea of self-acting economic forces that bring society in crisis can hardly be true.

Unlike Karl Marx, Friedrich List never accepted the conceptual framework of liberalism.

Friedrich List and his contemporaries laid the foundation for modern Germany and its major companies, Krupp, Siemens, Thyssen, etc. Regardless of what we think about German policy in modern time, one has to acknowledge that through Germany's eventful history during the past century, these companies have loyally supported their homeland through thick and especially thin. There is a difference between the Anglo-Saxon liberal tradition, where nothing is sacred, and the continental tradition, where the state and the motherland plays an important role also for the companies.

The familiar graph showing the rising supply curve and the falling demand curve has become the symbol of the free market. However, in the real world, the characteristic rising supply curve is only valid in special cases.

Textbooks in classical economics say that the curve is rising because when the actual production is approaching its capacity limit, the companies will have ever increasing costs for overtime, shifts, problems with inexperienced workers, repairs of production equipment and so on. It sounds plausible, only it is not true.

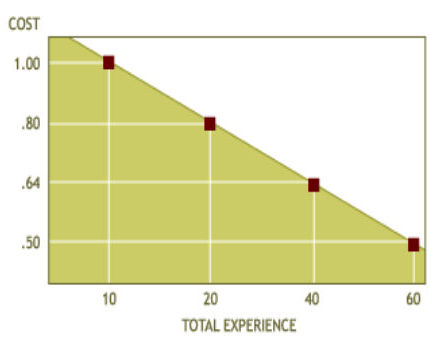

Boston Consultancy Group - The Experince Curve Boston Con 1974.

Everyone knows that the offered prices fall in step with that production volume's increase. Flat screen TV, cell phones, computers, solar cells, tents, tools of all kinds, everything has become cheaper with increased production volume.

Looking up from the harmonic curves in textbooks on classical economics and asking a production engineer, he will answer that long series of large volumes is simply just good. They open up opportunities for further automation and labor division. It is the short series that pulls teeth out, he will say.

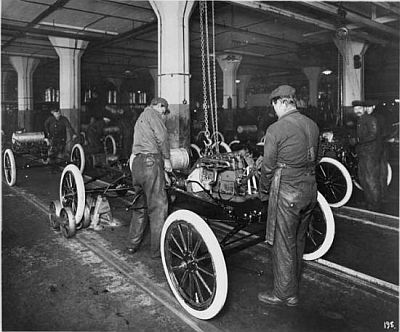

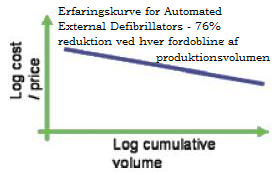

Already in 1974 the famous report by Boston Consultancy Group, "The Experience Curve Reviewed", proved that the added costs per. unit fall from 20 to 30% in real prices every time the productions volume is doubled - making room for both decreased price and increased profit.

The report concludes with the following remark: "The Experience cost effect is an observable fact. It can be confirmed by observation and can be displayed as a graph of a price experience curve for Model T Ford."

Since Boston Consultancy released their report, learning curves for countless companies have been made. It is an established fact that the cost decreases when the volume grows.

Ford T production line.

The market supply of goods depends a lot on the technical development, which comes in waves. Every time there a new technology is invented it will enable new products. There will be new business opportunities. The invention of computers meant a new generation of all products; Flat screen technology caused a new generation of computers and television and so on.

No one knows in advance how consumers will receive new products. An error margin of 30-40% to each side is not uncommon. So what is the idea of drawing supply curves that creates an illusion of an exact knowledge of consumers' response under alternating circumstances?

In classical economics it is assumed that human needs are infinite and insatiable. But this assumption is not true.

Demand curves for specific products are always shown declining, and they are probably also so in the real world. If you have already acquired some pieces of the commodity in question, you will be less eager to acquire another one. But then it must also bee so that consumers' overall needs for goods must be declining and eventually final.

It is also logical and obvious that the need for the last marginal benefits are decreasing, not only because consumers can not afford an unlimited number of benefits, but mainly because they do not have time to consume them. Because the day has only 24 hours, and life is final.

One often hears families complain that they have accumulated too many things of all kinds, and they find it difficult to decide to throw out, as the things have no defects, and at one time in the past they had paid money for them.

Learning curve for automated external defibrillators. 76% reduction of unit costs for each doubling of production.

It is not true that human needs are infinite and insatiable, there are limits to how much consumers will gather together and brood over.

The conclusion must be that both the supply curves and demand curves in the long run are declining. Nobody knows, if they ever will intersect. We remember that according to the classical economics a stable market price depends on that the supply and demand curves have different slopes. Only then prices will be driven back to equilibrium, represented by the market price. So we can shoot a white stick after most of the stable market segments. Since the whole society's economy, following the classical theory, is the the sum of its segments, we must also question the stability of the economy as a whole.

|

|

Thomas Malthus was born in England in 1766. His father educated him personally at home. In 1793 he became a professor of history and political economy at the East India Company College at Haileybury, which position he retained until his death.

Thomas Malthus 1766-1834.

He was best known for his contribution to population science, "An Essay on the Principle of Population". Population growth would overtake the world food production and trigger a global crisis, he wrote. Earth's resources are final, but humans natural instincts will motivate them to multiply themselves unlimited.

Malthus, however, was one of the most well-known economists. He joined the Royal Society and later the political-economic club, where he met the classical economists David Ricardo and James Mill. He was among the founders of the London Statistical Society in 1834.

He rarely allowed himself to be pictured because of a harelip.

Ricardo and Malthus disagreed on many things. David Ricardo was a strong supporter of a complete liberalism, while Malthus did not believe that a competitive economy by itself could always find a point optimal for the whole society.

Despite their disagreement, Ricardo and Malthus were personal friends. Maybe they now and then sat in the gentlemen's room and enjoyed a good cigar and a glass of port, while they discussed the society's economic condition. Ricardo is talking much about port in his articles on the benefits of international trade.

|

|

Contemporary classical economists are uncompromising supporters of business freedom and reject any notion about interference from the state.

Milton Friedman founded the economic school, "Monetarism", which is a modern variant of the classic economy. He is an unreconcilable opponent of government interference in the economy, and can be quoted for such comments like: "If you put the federal government as Head of the Sahara desert, in a five years time there would be a shortage of sand."

Ludwig von Mises - the founder of the Austrian school of economics.

Representatives of the "Austrian School of Economics" usually express themselves in a more subtle and philosophical way. But they are even more negative against government interference in the economy. Founder of the Austrian School, Ludwig von Mises, said for example: "In history, the state may and often have been the main cause of discontent and disasters."

Strange enough, as companies in modern times have grown bigger and more powerful, and markets simultaneously have developed to non-transparent oligopolies, the classical economists have become increasingly more dismissive of giving the state a role in the economy.

They praise the nineteenth-century classical economists as their spiritual origins, but they seem to have forgotten that Adam Smith himself supported government intervention.

Adam Smith supported a series of protectionist English laws called "Navigation Acts", which stated that all goods sent to England, Ireland or the English colonies were to be transported on British ships, and that the plantation owners and merchants in the colonies were only allowed to sell their products to English merchants, or pay a custom duty, when they sold them to other countries' merchants. Colonies exported such things as tobacco, sugar, cotton, timber and so on. The Navigation Laws were a major reason for the rebellion in the American colonies in 1775.

Thomas Malthus supported the idea of import duties on corn, to encourage English agriculture. He warned against the rapid industrialization of England. Economic development had to be balanced between industrial development and agricultural development, he wrote. One-sided development of industry at the expense of agriculture would not only create moral and political problems but also the risk being strangled by its own success.

Industrial Staffordshire.

He viewed the economy of society from a broad moral and political point of view and emphasized a harmonious development of the nation. He pointed out that some situations, clearly marked by economic imbalance, were strikingly persistent and seemed to have difficulty finding balance by themselves. Unlike most of the economists of the time, he did not think that capital accumulation (saving) was good for the economy in all situations.

There should be a demand for the products that the new industry produced. And when agriculture was backward and workers in principle were paid after Ricardo's "iron law of wages", i.e. existence minimum level, then there would not be enough customers in the store, one should believe.

But back then England, and especially the city of Manchester, were the "World's workshop", and Malthus fears were dashed by a very large English export.

However, his analyzes that some markets not by themselves would find an optimal point of balance in the short term, were realized almost a hundred years later in the United States of the thirties. The U.S. industry had evolved into the world's largest and most effective. It produced all kinds of goods. But large parts of agriculture was backward and the industrial workers earned not enough to buy all the new products.

The factories could not sell, and they dismissed employees in heaps. The state had to step in with the "New Deal" policy, introduced by President Roosevelt in accordance with suggestions by John Maynard Keynes.

Prior to the crisis of the thirties, there was a boom in stocks, so there were some who had plenty of liquidity.

What do you see?

We know those trick images, where what you see depends on the eyes that look. What represents this picture? Is this the face of a young woman seen partly from behind or the face of an old woman in profile?

A series of prices and quantities will in a similar way be interpreted differently by different economists.

A classical liberal economist will clearly see, how the dynamic market forces are in the process of forcing the market into balance. The pendulum swings back and forth, but it will eventually settle on the optimal price. In the eye's of the classical economists prices and quantities are either in equilibrium or in the process of finding a new equilibrium after an external disturbance.

A more sober economist would see the dark forces of future and uncertainty in action, he will not force reality into such fixed forms.

Many imagine the relocation of production activities from Europe to Asia as part of such a classic economic pendulum, which slowly swings back and forth - something completely natural, they are comforting themselves.

Initially the Europeans are earning close to dkr 200 each hour, and the unskilled Chinese and Indian workers earn dkr 10 per working hour. After the pendulum has swung to the east, the Chinese wages will inevitably rise and the Europeans will cut down their hourly rate in order to pull the pendulum back, some think. After some few hundred years, when the pendulum has done several swings, it might settle on a stable world market price some where in between.

Chinese factory.

Ordinary people are powerless and unable to understand the de-industrialization of Europe, perhaps they think and imagine that there is a deeper economic meaning, which common people are not granted to understand. For example, it can be likened with a big economic pendulum that slowly settles in economic balance to the benefit of all.

There is no deep and mysterious financial sense in the de-industrialization. And such economic pendulum will never be left in peace to complete its swings. There is simply the fact that the large international companies may have their goods produced in Asia for a fraction of the European costs. For example, it costs a fraction of a dollar to produce a pair of socks in Guangdong province near Hong Kong; they can be sold in Europe for maybe two dollars or more. Transport costs are very small, for this kind of commodities neglectable.

That is really business which is understandable. The companies know well that the de-industrialization of Europe will be a disaster for the nations, but it is a temptation that they can not resist. After us comes the flood for our sins, and so far ithas worked very well, they seem to think.

Perhaps they reason that if everyone else does it, they also need to do it; or, if unavoidable, why not come first.

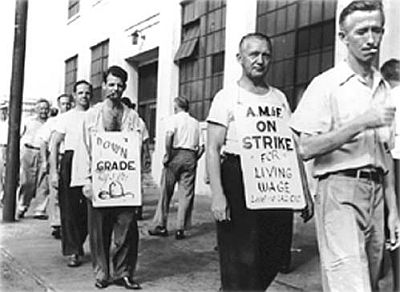

Western workers on strike.

The companies defend their actions saying that they have no other choice, the cost level in Europe is simply too high, they say.

Only the theoretical economists can see all the elegant curves and lines that extend in the price-quantity plane, marginal, average and aggregate curves. Common practical economists can only note that perhaps a particular product on their shelves have been sold out faster than they had imagined. They will perhaps think that the price has been too low, but hopefully, the customers have also bought something else. Viewed from the shop floor one can never know whether you have achieved the stable market price or not.

In the classical economics, it is assumed that supply and demand are

two completely independent functions. Before the potential sellers and buyers are entering the marketplace, they independently have made themselves entirely clear what they want, in what order, and how they will react to this and that price. The famous classical economist Alfred Marshall compared the supply and demand with the two knives in a pair of scissors, which independently sets prices and volumes throughout the whole economy.

But it is clear to everyone that supply and demand are not independent. A very large proportion of demand is caused by the selling firms' marketing.

Textbooks in classical economics state always a rather long list of preconditions for the market to function. They are never satisfied. One sits and wonder if the textbook-author himself believes in his model.

Five commonly stated assumptions are:

1. There must be many suppliers and buyers, so none of them have any control over the price

In the old days in the fifties and sixties, there were many agents in each industry, small craftsmen companies, retailers and small transport companies. It is all over. The thousands of small companies, self-employed and retail stores have given way to the big chain stores and international firms. The market type is oligopoly. The small shops were briefly transformed into pizzerias, second-hand cloth charity shops and convenience stores.

2. Products must be homogeneous. Companies must offer comparable products.

All manufacturers are doing their utmost to ensure that their specific product must be something special. They are trying to build a brand. It is called monopolistic competition. It is seen most distinct by expensive watches and ladies handbags. You do not buy just a watch or a handbag, you buy a Rolex or a Gucci - if you can afford. In general, the precondition about homogeneous products is only satisfied for decidedly raw commodities like meat, fish vegetables, flour and such.

3. There must be perfect information. The market must be completely transparent. All agents should know all prices and qualities.

There are websites, which give a pretty good transparency, such as Bilbasen.dk and Boliga.dk. The websites of the large grocery chains also do provide good information, foetex.dk, superbest.dk and so on. On the other hand markets for mobile phones and fashion lie in outer darkness.

4. There should be equal access to technology. All companies must be able to buy all kinds of production machinery.

Any company can buy standard machines such as rollers, metal cutting machines, welding machines, molding machines, etc. But many have developed their own processes as they, of course, do not offer to everybody.

5. There should be free access to the market. Any company and any person may be able to seek their fortune in any market.

In Denmark the law, "Næringsloven", of 1857 stated, that it is free for all to make business in any profession. However, most modern markets are oligopolies, it means that they are dominated by a few large companies that will do their utmost to prevent newcomers from gaining market share and get part of the profits.

|

|

David Ricardo was born in England in 1772. He was the youngest of 17 (seventeen) children. His Jewish family came from Portugal. They moved to England shortly before Ricardo was born. When he was fourteen years old, he began helping his father in his brokerage business.

David Ricardo 1772-1823

When he was 21 years old he married a Christian woman and himself converted to Christianity. For this reason, his family took away his right to inheritance.

Ricardo, however, was a brilliant investor, in a short time he earned a fortune, bought an estate and retired from business life at the age of 32 years. He became a member of parliament and devoted the rest of his time to political economy.

He is best known for his treatise on the benefits of mutual international trade and for his theory of the "iron law of wages". However, these were merely two sides of same coin, namely his lifelong struggle that England should become industrialized as fast as possible and at any price.

Industrialization required that British merchants could export the products. This brought the mutual benefits of international trade into the picture. The industrial products might be cheap. For this reason, factories cost must be low, especially labor costs. Thus brought his "iron law of wages" into the picture. But if wages should be low, so the food should also be inexpensive. Therefore, he also called for import of cheap foreign grain.

England was truly industrialized quickly, but not without the moral and political costs, which his friend Malthus had warned against. Socialism was born in England; as it is well known.

England's industrialization in the nineteenth century resembles China's industrialization, which is taking place right before our eyes. As the Englishmen, they attach great importance to exports. They keep a watchful eye on the wages, it must be low, so their products can remain cheap and competitive. If wages must be low, so the food must be cheap. Therefore, the Chinese peasants do not pay tax and they receive government subsidies by purchasing television and other modern appliances.

|

|

The liberal theory assumes that what is rational and beneficial for the individual producer and the individual consumer, is also rational and beneficial for the whole economy. The economy of the nation is based on numerous individual choices and decisions. When decisions of the individual are rational and thoughtful, so they will also cause that the whole economy develops rational and beneficial.

As the liberal economist, Hayek wrote: "Individuals are in the best position to judge their circumstances, interests and what goods they prefer, and therefore individuals are best suited to make decisions in the marketplace."

One can say that liberalism assumes that society's economic decisions should be decentralized down to the individual consumer and businessman. "The market is always right", as they like to put it.

But, when all depends on all these individual agents in the market, then the liberal economists must also be able to show that these agents are sharp enough to make sound decisions that are consistent with their own objective interests. If they can not, it will be logically impossible that the individuals' decisions can be the basis for the whole economy's positive development. This requirement is traditionally tackled by the theory of "economic man".

Marketing is a very important and useful discipline.

The term economic man usually refers to "a perfectly rational person, who by always thinking marginally maximizes his economic prosperity and achieve consumer equilibrium".

"The economic man" can be traced to Adam Smith, who wrote that "every man is in some degree a merchant" in his quest for "self-improvement".

Before the economic man enters the marketplace, he has made his needs completely clear, he has ranked his wishes from the most desirable to least desirable. He will make his choices objectively, cool and calculating.

However, "the economic man" is easy to fool.

Marketing is one of the most important subjects in business. It describes how to advertise and price products in the real world. Companies spend millions upon millions on marketing, and it is because it works. Experts in marketing pull the simple-minded "economic men" around by their noses. An important element of this discipline is to take advantage of the potential consumers' longing for identity, dreams and unconscious feelings.

Some liberal economists are trying to save the situation by defining themselves out of the problem. For example, marketing can influence a consumer to choose specific products from an unconscious desire to signal a particular lifestyle and identity.

The economic man

They write that the consumer precisely wanted to signal this particular lifestyle, and have had this desire in his list, even before he stepped into the marketplace. He got exactly what he wanted, namely, a product that signals this identity, and therefore he is a rational consumer, a true "economic man".

In this way, no matter what an agent on the market are tempted to buy, you can define that it was exactly, what he wanted, and therefore he is a true, rational, and calculating "economic man" and thereby save the liberal theory.

But a really cool, calculating and evaluating "economic man" will not be manipulated by a technique which utilizes his unconscious dreams, fantasies and feelings against him. And when consumers so readily respond to sophisticated marketing, it is precisely because, they are no such rational "economic men", as the liberal theory requires.

Next, the classical economists must be able to show, that if the above is

met, and the individual agents, the "economic men", really are such sober, and calculating persons, who objectively chose in strict accordance with their real interests, then their decisions will also contribute to the whole economy's positive development. So, what is good for the individual, is also good for the whole.

So the question is if the rational individual decisions in the direction of individual self-improvement really will lead to a beneficial development of the entire economy, as the classical theory assumes.

Trafic jam on an American Highway

We know this type of problem from the traditional discussion about motoring. For the individual, shall we say a family man in one of China's big cities, it is just happiness to have a car. Get the baby, the dog and the mother in law into the back seat, and you're ready to go anywhere. But it is also clear that if all five million inhabitants in a medium-sized Chinese city does this, then no one is going nowhere. Everything will be total chaos.

Keynes later showed the problems with failing demand. Each firm is assumed to maximize profits. They may have managed to keep their labor costs down on an attractive low level, thus they get a good result on the bottom line, and that is what the whole thing is about, it is assumed in the classical theory. But if all companies do, then a very large proportion of the population - which consists precisely of employees in the firms - have very little purchasing power and the firms will have problems with sales revenue.

This means that what is advantageous and rational for the individual company will be disadvantageous to the whole economy when many or all do it.

This leads to the logic of stimulating demand. Keynes was right about this for his time. But however, it does not work in modern times for smaller nations, because increased demand will be directed almost exclusively against imported products.

Hospital employees on strike.

So let's try to turn the problem around. In the classical theory it is assumed that all agents will work for their self-improvement not only the businessmen. Let us imagine that a single strong trade union managed to push through a very favorable agreement with the employers. There is nothing wrong with this? Is there? Everyone is in charge of his own happiness. Shall we say a thirty hour week and eight weeks of annual vacation. It will indeed be pure happiness for the individual worker, plenty of time for family, friends and hobbies, and there will even be opportunity to come and say hello to the colleagues now and then.

It would clearly be a significant self-improvement for the individual

worker. But however, if many or everyone does it, the Danish economy will quickly get into trouble.

It would be in beautiful consistence with the idea of the economic liberals that everyone should work for his own self-improvement. But again, what is rationally advantageous for some individuals, becomes disadvantageous for the whole economy.

Closed.

True liberals would argue that long before "everyone does it" will market forces be deployed and have established a perfect optimal equilibrium.

There is to say that the labour market many times in history has stabilized, but at a point that is not optimal, as Keynes wrote is possible.

Right now in this time, many companies take decision to close their own production facilities in Denmark, or not to start them because it gives a bigger number on the bottom line for the particular company doing so. This is in perfect agreement with the classical economics, which assumes that firms are profit maximizers.

A ramschaccle house in the backyard of Denmark.

However, when all or many maximize their profits in this way, it will be harmful to the economy as a whole. It will mean an end to Denmark as an industrialized nation. The foundation, which the companies originally built on, will crumble beneath them.

Today the companies huddle together around Copenhagen with its high wages and property prices. The shives all to their bottom line, where they think they can see that it pays off to stay in the metropolitan area. In this way, huge resources are lost in the less populated areas to the harm for our fatherland, thanks to the liberal principles that everyone is master of his own happiness, and all major economic decisions should be taken by the individual agents in the economy.

The money market is the greatest of all liberal illusions. The idea of money as a scarce resource that is allocated optimally in the market, where the savers create the supply, and the businessmen the demand, is the financial industry's legimentation to take their "cut" of the citizens' savings.

Supply and demand for money

In the classical theory is assumed that the higher the interest rate, the more disposed people will be of saving, and the lower the interest rate, the more businessmen will be disposed of borrowing for their projects. Where the increasing supply meets the falling demand, the market price of money is determined, which is the rate of interest.

It is all rather logical, ceteris paribus, as it is said. But the problem is that the magic formula "ceteris paribus" cuts away everything that is important.

Keynes has suggested that saving is more a function of income than of interest. The more money people earn and the bigger their fortunes the more they will want to save. That means the more wealthy a nation becomes the bigger its aggregate saving will be.

The human needs are not unconditional endless and insatiable. It can clearly be seen when someone gets an unexpected fortune, an inheritance or a lottery win, they will most likely choose to save most of the money and earn interest. It will seldom be the case that they are considering whether the rate of interest is high enough for saving, or they should spend all the money here and now.

Besides, some economists think that there really is no connection between the banks lending rate and marginal productivity, aggregate saving or the like because the central banks and the private banks can create as much money as they want. Money is not a scarce resource.

Also, the entrepreneurs' and businessmens' demand for loans is not primarily a function of the rate of interest. It is, perhaps even more, a function of the technological development. The appearance of a new material, a new production method or a new technique will call for investments as fast as possible. New methods must be incorporated in the companies' products or production, it must be done before the competitors do, and it can not be fast enough. The rate of interest has only a minor influence on such decisions.

So, it is not unconditional true that savers' offerings are a steadily rising curve as a function of the interest. The link between savers and borrowers are not so intimate as the classical economists' graphs' tell us. Basically, the money market cannot at all be described by such graphs.

The government, the national bank and private banks can in cooperation create all the loanable fund that is needed, based on a very modest level of saving. The private banks can borrow money from the National Bank for zero point something of interest, which they can lend to the entrepreneurs and businessmen. Based on relatively modest deposits, banks can multiply their lending.

A man looks on stock prices

If it should happen that a sudden shortage of loan capital shows up, it will not be a big problem for the financial organizations to create the money that is needed, regardless of savers' behavior. It has been demonstrated very convincingly in modern times by the money creation of the central banks in Japan and the US, and latest by the European Central Bank.

The sweeping victory of the monetarists in the early eighties under the leadership of Reagan and Thatcher meant that everything should be privatized and left to the market - including private citizens' retirement savings. Suddenly millions of small private investors found themselves in the market for shares and bonds looking nervously around. Large investment funds and investment banks have since had their heydays. As a matter of course they take their "cut" of ordinary people's retirement savings.

The classical economic theory claims that they are operating in the market for capital goods, allocating and optimizing the scarce liquidity to where it can be fully exploited for the benefit of the society. But if investment funds are not a scarce commodity at all, but rather something that can be created and quite probably also wiped out as needed, then there is nothing to optimize and allocate. Big international investors will then not have this legimitation for their right to take their cut.

|

National System of Political Economy - Modern History Sourcebook From George Friedrich List. National System of Political Economy. David Ricardo: The Iron Law of Wages, 1817 - Modern History Sourcebook From David Ricardo. On Wages "The Revolution that never was" by Will Hutton - Vintage 2001 "Economic of the Real World" by Peter Donaldson - Penguin Book |

| Til start |