| Home DH-Debate |

When the tear gas burns in the eyes and the black smoke from the burning tires prevent any clear view, one can accidentally come to the view, that globalisation is something that is good for the economy, but however - bad for the developing countries.

Anti Globalisation demonstration in Seattle 1999.

The masked troublemakers distract the attention from the true content of globalisation.

Globalisation represents a huge and most likely excessive confidence in the global market forces. It causes a transfer of technology from the West to the East. The global market will move the bulk of manufacturing activity from the Western world to the low costs countries in the Far East.

It will create a global elite of companies and individuals who will come into possession of dizzying wealth and thus an enormous power that will far surpass the upper classes of former times.

The following statements are often cited as support for the globalisation process. We will discuss the pros and cons.

1. A Large Global Market will Create Stronger Market Forces and thereby Lower Prices

2. International Trade Based on Absolute Advantages

3. International Trade Based on Relative Advantages

4. Globalization is Inevitable

5. The Favourable International Division of Labour

6. The Technology Transfer to Asia does not Matter

7. Globalization is Good for the Development of the Poor Countries

|

|

| 8. Qianlong, Mao Zhe Dong and Globalisation | 9. Literature |

|

|

The main argument for globalisation and the consequently created worldwide free trade is based on, that in the huge global market the market forces will be much stronger than in the old national and regional markets.

Free worldwide trade will create an enormous global market. The stronger market forces in this huge market will force companies to be even more effective. The increased efficiency will generate increased growth and wealth.

Adam Smith.

Adam Smith wrote in his "Wealth of Nations" about the market forces: "Every individual necessarily works to make society's annual profits as high, as he can. In general, he has no intention to work for the public interest; he does not know, how much he contributes to it. He just intends to increase his own profit, and in this, as in many other cases, he is governed by an "invisible hand" to contribute to a purpose, he does not intend to support. By pursuing his own interest, the individual frequently promotes that of the society more effective, than when he intends to promote it. I have never known much good done by those, who felt, they had to trade for the good of the society."

"The invisible hand" represents the market forces, which have been so important for the economic development of the nations of the free world. It goes without saying, that as market forces have been such a beneficial factor in the national markets, then the much stronger market forces in the greater global market will be an even more beneficial factor and further support economic development. Due to the increased competition in the large global market, companies will be more efficient and the consumers will, therefore, come to benefit from lower prices, more choices and better service than before.

"The invisible hand" works by the market forces. The beautiful economic model of the market, which we know so well, explains this. The rising supply is a function of the price and decreasing demand also as a function of price. The point, where the two lines intersect each other, defines the market price, which is shown by a horizontal dotted line to the vertical axis.

This is exactly how we perceive the "Free Market", which represents the capitalism to which we really have no alternatives.

However, this model applies only to "perfect competition", which mainly means, that the market has so many suppliers and consumers, that they individually cannot influence the price.

Wall Mart.

The markets, on which today's major international companies operate, can be better characterized as oligopolies. This means, that there are so few players, that each one is able to influence the price. Oligopolies are characterized by that the agents are carefully watching each other. This leads to; "follow the leader" strategies, mutual agreements and possibly price wars, in case of new players seeking to enter the market to get part of the profit.

There can be no doubt, that the new international oligopolies are more cost effective than the large number of small family companies which populated the market decades ago. It is a huge advantage to be big. The enormous markets, which are being created by the globalisation process, will most likely also generate even bigger oligopolies with even more cost-effective huge companies.

But one of the problems is, that much of this improvement of efficiency will possibly not benefit the consumers. That is, the oligopoly companies can often determine the price in a non-official cooperation with the other companies, with whom they share the market in question. They will be inclined to cooperate on prices, which optimises the total revenue of the market concerned.

When the businessmen of every nation focus on those business areas, where they have absolute advantages, it will make everybody richer.

The Wealth of Nations by Adam Smith.

Adam Smith wrote in his "Wealth of Nations": "If a foreign nation can provide us with a commodity cheaper, than we can make it ourselves, then it is better to buy it with a part of our own production, in which we have some advantage."

For example, it is not clever to grow wine in Denmark, because our climate is not advantageous for this production. However, our climate is well suitable for fur breeding. The cool weather helps to create a good tight quality fur, and also we have easy access to fish to feed the fur animals. Pigs breeding are also best in a cool climate. In these industries, we have some advantages, as Adam Smith would have expressed himself.

So it pays to use our absolute geographic advantages and produce fur and pork, sell the products to customers in warmer countries, and possibly buy wine for the money.

David Ricardo's famous example describes the trade between Portugal and England.

Portugal exports port wine to England and England sells cloth to Portugal. This international trade is mutually beneficial. Both nations become richer, than they would have been if the Portuguese had drunk all the wine themselves, and if the Englishmen had kept their cloth for themselves.

In this way, the global free trade benefits all and will make all nations richer, than they would have been without globalisation.

Saudi and Kuwait export oil to the West. Kazakhstan and Australia export uranium. These countries have an absolute advantage in these commodities. In return, the West exports advanced industrial products, Italian art ware and Danish fur and pork to them.

The Asian countries and Eastern Europe have an absolute advantage in an abundance of cheap labour power. The Western countries have an absolute advantage in our superior technological level. Therefore, it pays for the West to buy labour-intensive manufactures - for example ships - from Asia and in turn export advanced technical equipment. In this way, globalisation makes both parties richer in accordance with Adam Smith and Ricardo's famous theory.

The overall objective of the classical economists Adam Smith and David Ricardo was to devise guidelines for such decisions, which maximized the wealth of England. Precisely for this reason, they recommended the nation's merchants to sell cloth to Portugal and import Portuguese port wine.

The assembly shop of the Belgian shipyard Beliard & Crighton - closed 1988.

But what if it had come to light, that the Portuguese cut open the English jackets in the seams and copied the design. What if the Portuguese had used the British currency, which they had earned from their port wine, to buy English spinning machines and steam engines. What if the Portuguese bought a complete English textile factory disassembled it and shipped the parts to Portugal. What if it had become increasingly clear, that the Portuguese intended to make use of their cheap labour power to manufacture and market precisely the same textiles as the Englishmen, just cheaper.

Would Adam Smith and David Ricardo then also have been so sure, that trade with Portugal was good for the wealth of the English nation?

Globalisation is not only about trade in commodities. Whole factories and industries in Europe and the United States are being closed and the production moved to Asia.

The Ruhr Valley was the heart of Germany's productive power. Through more than 200 years the smoking chimneys of the Ruhr Valley produced the iron and steel, which was the backbone of the nation's industry. Generations of workers and engineers built up an outstanding sum of knowledge about steel production. Sons succeeded fathers at the blast furnaces. When the nation called, the factories sent out an endless stream of armoured tanks, field guns and grenades.

During the eighties and nineties, the Korean steel industry became the world's most efficient. Also, the Chinese entered the steel market. While the Ruhr workers unions fought for a 35-hour week the Chinese workers worked 10 to 12 hours a day for about one-twentieth part of the wages that the Germans got.

By the turn of the millennium, it was over. Steelworks and factories in the Ruhr began to close, one by one. In his book, "China Shake the World", the author James Kynge describes, what happened.

|

Huttewerk Phoenix in Dortmund, with permission from Industriedenkmal.de.

Thyssen Krupp steelworks in Dortmund was one of the largest in Germany. The Germans called it Phoenix because it rose from the ashes after the Allied bombings during the Second World War.

Within a month after the Thyssen Krupp company had closed its steelwork, it was bought by a Chinese company. They sent thousand Chinese workers to the Ruhr in order to dismantle the entire factory and send it to China. The Chinese workers gave the Germans an illustrating teaching about the dawn of new times. They worked 12 hours a day, seven days a week. However, because of German pressure, the Chinese accepted to have one day off each week.

It lasted less than a year to disassemble the plant and send the pieces to Shanghai. A total of 275.000 ton equipment along with 44 ton of drawings, documents and manuals were sent to China.

This is also the possible destiny for the rest of the European shipbuilding industry, and ultimately all forms of labour-intensive production, where the products can be transported in containers, transferred electronically via the Internet or moved by any other mean.

Adam Smith and David Ricardo only gave instructions on how the nation's merchants should export the finished English products in order to maximize their own wealth and the wealth of the English nation as good as possible. Globalisation, on the other hand, is a much more large-scale and long-termed process. It is not only about finished products, it is also about moving whole industries and thereby influence the future of the nations for decades, perhaps for hundreds of years.

The classical economists' theories concerning how to make use of mutual absolute advantages in international trade, cannot be taken for support of moderne globalisation. That is a complete other problem affecting the future of the nation and its survival. Such decisions should not, strictly speaking, be left to the nation's merchants.

When the businessmen of each country focus on such business areas in which, they have comparative advantages, it can make all nations richer.

David Ricardo is most famous for his theory of "relative (comparative) economic benefits of trade". The theory shows, that even if a nation has no absolute advantages, so it may still pay for this nation to trade with other countries.

David Ricardo.

Ricardo described the theory by assuming that two nations, England and Portugal, produced only two goods, namely cloth and port wine.

Assume that Portugal is more productive than England in the manufacture of both cloth and port. The cloth production in Portugal was twice as productive as the one in England, and in the port wine production, they were three times as productive as the Englishmen.

Portugal has a relative advantage in the production of port because this is its biggest production advantage. Britain's relative advantage lies in cloth production because here is their relative handicap smallest.

This indicates that Portugal can optimise their resources by specializing in port wine production, where they have the greatest relative advantage. It implies, that they should send their sheep to the slaughterhouse and plant wine on their former pastures.

The Englishmen, on the other hand, should minimise their handicap by specialising in the cloth production. This means that they should cut down their wine plants and instead open the land for grazing sheep.

Globalisation removes barriers to trade between nations. Therefore, nations can expand their trade and thereby exploit their relative advantages and minimise their relative disadvantages, and thus all will be richer than they were before.

Ricardo was probably right. There are great benefits to gain from trade. But as mentioned above, the process of globalisation involves more than just trade with finished products.

It is certainly cheap to buy steel and ships in Asia, and perhaps it will continue to be affordable for the next 6-8 years. But when the Chinese and Koreans have achieved their goals, and all European and American heavy industry have been abolished, prices will most likely become different. Asians are just as smart as we are, and they are very talented merchants.

Korean Steelwork.

By then all the European machines will have been sold as scrap iron, and the factory buildings will have been turned into gambling houses and other entertainment. All key employees will be retired or have found other jobs. All the experience, which has been accumulated over generations, will then be lost. It will be a very lengthy process to start a heavy industry again.

Poor countries in this world, which had become richer, did not do it by strictly following Ricardo's recommendation opening for foreign trade without restrictions. They developed their new industries inside a protected national or regional economy, and only later they gradually opened up the borders. So did Western Europe after the wars, so did Japan and Korea, and China does it today.

As an Englishman, Keynes was in his youth convinced of the unconditional benefits of international trade. But in 1933 he wrote in "National Self-sufficiency": "A considerable degree of international specialization is necessary in a rational world in all cases, where it is dictated by wide differences of climate, natural resources, native aptitudes, level of culture and density of population. But over an increasingly wide range of industrial products, and perhaps of agricultural products also, I have become doubtful whether the economic loss of national self-sufficiency is great enough to outweigh the other advantages of gradually bringing the product and the consumer within the ambit of the same national, economic, and financial organization. Experience accumulates to prove that most modem processes of mass production can be performed in most countries and climates with almost equal efficiency."

He recommended a combination of quotas and tariffs to protect vulnerable industries.

Globalisation is a natural consequence of modern technology. Container transport and the Internet have been invented and cannot leave the World again.

Kinesisk tekstilfabrik.

It is not possible to fold up the ideas and put into the brain of the inventors again. It is like this in this world, that everything, which is possible, will be done, if someone has an advantage from it. Globalisation is coming, whether we like it or not. Why resist progress and the inevitable development?

If only one of the major international firms in a given market builds a factory in a "low cost" nation, shall we say China, Brazil or Vietnam, they have achieved a cost advantage, and their competitors are forced to follow suit if they do not want to lose market share. VW was the first car-manufacturer to start production in China, and since then many other followed suit. It is virtually inevitable that at least one of the agents in a given market will choose to reduce their costs in this manner and thereby trigger a domino effect.

Bretton Woods konferencen.

Globalisation is not a process, which spontaneously grows up, as weeds. It is the result of conscious political decisions.

Modern globalisation has a birthday and birthplace. It was launched on the basis of political decisions taken at Bretton Woods in the U. S. state New Hampshire in July 1944.

This conference brought together the world's leading economists and politicians to create the foundation for a new international economic order, which should form the basis for the economic recovery after the World War II devastation. The "World Bank" and the "International Monetary Fund" (IMF) were founded at the time of the Bretton Woods gathering. Based on the decisions of the conference also the "General Agreement on Tariffs and Trade" (GATT) and the "World Trade Organization" (WTO) were formed.

It is the conscious decisions in these organizations, which provides the content and sets the pace of the globalisation process.

Let us take a moment and imagine, that the world was the reverse. That it was Asia that had the technological edge, and Europe and America were "low cost," under-developed, areas.

Would the Koreans and the Chinese then have transferred production and thus their technological knowledge to under-developed Europe, and thereby risked creating future competitors?

Shanghai Pudong skyline.

Korea is world's most nationalistic nation. The heads of the big Korean conglomerates would meet for an informal dinner in an expensive restaurant in Seoul and propose a few toasts for Korea in traditional Korean rice brandy. So they would agree, that it was better to out-source Christmas decorations, Buddha figures, kitchen utensils, toys and the like only. One should not sell the hen, that produces golden eggs, they would think.

Many Chinese men have very strong national feelings. They love to consider maps showing China's great extent during the Qing Dynasty and remember the greatness of their ancestors. They can identify major areas of Siberia, and Mongolia, as in fact Chinese and talk about unequal treaties. One should not imagine that the large Chinese companies are struggling with the teeth in the throat of each other in fierce uncompromising competition. Of course, they are competing, but they are all Chinese, and the ultimate goal is China's greatness or at least the greatness and power of the Communist Party of China. There would come a discreet message from the highest government level, saying that only the production of very simple products should out-sourced. In former time time back in history they had a monopoly on silk production, they also guarded the secrecy for many centuries.

But leaders of the major corporations of the West feel that the concept of nations belongs to the past. They dream of becoming tomorrow's powerful and dominant global elite feeling free to manipulate Asians, Europeans and Africans.

It is often said that it is financially advantageous to leave the polluting heavy industry to the Asians and instead focus on business areas with a greater margin of profit, for example in the service and financial sectors.

Typical polluting heavy industry.

The West has a highly educated and skilled workforce. It is a waste of resources to use these valuable employees for simple and monotone work in steel mills, shipyards, assembly lines and other manufacturing plants. It is far more beneficial to let the Asians do the hard and dirty work with little added value and instead, use the educated workforce of the West to more advanced production with higher added value.

Business is business, and in such sectors as service, entertainment and finance bigger margins of profit can be found than in the polluting manufacturing sector. Only by consistently and uncompromisingly choosing such investments, which give the highest returns, we can optimise our wealth.

Steel mills, shipyards and similar heavy industry constitute the backbone of a nation's productive power. Japan, South Korea and China chose to start early with these industries, not just because it involves many relatively simple jobs for their many unskilled workers, but particularly because heavy industry is the foundation of all of industrialization. When the West abandons its steel mills and shipyards, leaving the dirty work to the Asians, it will be the beginning of the end of our status as industrialized nations.

An opening of a trade fair for light industry products.

All business areas are not equally important for the nation. There are some businesses that produce such products, which satisfy deep basic needs, such as agriculture, fishing and heavy industry. There are other business areas, which produce such a service, as it is nice to have, but which satisfies more marginal needs, like fashion, restaurants, travel and entertainment. Although the margins of profit in these latter areas in the short term may be quite large, it is still secondary business areas, which cannot alone efficiently support the wealth of the nation.

It is unrealistic to expect that the Asians will confine themselves to simple products. The Japanese started with assembly plants for motorbikes, steel mills and shipyards, and Japan is now one of the World's most advanced industrial nations. Korea follows them closely on the heels. The Chinese are still very keen to attract productions, from which they may learn something. They believe themselves, that they still need some ten to fifteen years of their apprenticeship as an industrial nation. But then they will be ready to take on the world market in all areas of business with their own brands. They will offer the same as the Western companies, only cheaper.

There is no evidence that, for example, the Chinese intend to raise their employees' salaries significantly over the next several years. They will give their workers a little more every year so that the people will have a feeling of progress. But it will never be anything with a factor of ten or twenty, which is, what is needed to align the cost of manpower with the West. They will use their low cost to enter all the world's markets with their own brands when they in a few years will be ready.

Nanjing Road in Shanghai.

One day in the future, the Chinese and Indians will have a similar buying power, as the peoples of Japan and the West have today. It is therefore extremely important for the Western companies to be present in these enormous markets with billions of potential customers. The way to do it is by setting up sales offices and production units in China and India. Companies must position themselves well in advance in order to become an integral part of the market.

Western companies do not need to worry about, that setting up of production units in these countries will cause transfer of technological knowledge to possible future competitors.

We only have to make sure, that we any time maintain a technological lead. Thanks to our high level of education and our natural superiority, we will always be able to create new products and technologies that will provide opportunities for new business areas.

It is also well known that the human needs are infinite and insatiable. Then there will always be possibilities for new business areas.

The Industrial Revolution began in England. In 1709 Abraham Darby from Coalbrookedale by the Severn River found a way to produce steel in industrial scale from iron ore using coke. Since then the line of inventions followed beat by beat. It was the creation of the steam engine, spinning machinery, railways, steamships and much more.

It should serve to the eternal credit of the English nation, that the Englishmen invented the basic technology completely by themselves. They were the first, and they had nobody to copy from.

The rest of Europe and the U.S were quick to follow suit. The Germans invented the automobile, Americans invented the airplane, and an Italian invented the wireless telegraph.

It took the West about 300 years to develop from the blast furnaces at Coalbrookdale to our modern technology. All this the Asians had acquired in eighty years or less.

The industrial revolution in England.

It is much faster to acquire already proven technology than it is to invent something new.

We do not know, why the industrial revolution started in Europe and not in Asia. We have no reason to believe that it was caused by any natural or biological superiority. It would be a big mistake to build a strategy for the future on such dubious assumptions.

But however, even if we really could maintain a kind of technological edge related to the Asians in one or another way, they still would be able to follow us on the heels. They would very quickly be able to market the same products or very similar products, as the innovations of the West, only cheaper.

One day I met an employee from a Danish company, which produces electronic measurement equipment. They had just started a branch in China. He was deeply impressed by his new Chinese employee. "He had read all the manuals, and he can cite them almost by heart," the Dane said. I could not get over my heart to tell him, that their new Chinese employee most likely will become a key figure in the new Chinese company, which will be established in a few years to produce just that sort of measurement equipment. This is how the transfer of technology takes place in practice.

The large international companies are responsible for the transfer of technology to future competitors. The top managers of these companies surely think about their transactions, that this is just a demonstration of their dazzling business skills. But in reality, Europeans are selling our rights as the first borne for a dish of lentil.

It is not true, that human needs are infinite and insatiable and that new business opportunities will constantly emerge. The first basic goods such as food and housing, we desperately will try to acquire. The last marginal goods as a second home or a travel around the world, we will buy almost for fun, if we cannot find other ways to spend the money.

Free trade and free movement of capital across borders is the key to the development of the poor countries. All barriers to the free flow of goods and services across borders should be removed. Free markets and free capital movements will, in the long run, benefit everybody. When the high tide comes, it will lift all boats, large and small.

Precisely for this reason the IMF's economists often make it a condition for lending to developing countries, that they in their own best interests must open their borders to international trade and free capital transfer. Each country should specialize in the products and services, in which they have some absolute or relative advantages, and on this foundation take part in international trade.

We have in the World examples of poor countries, which had become wealthier. They did not do this by opening their borders indiscriminately and without pre-conditions to the international capital and the big international companies.

During Western Europe's recovery after the world wars, all nations controlled capital transfer over their borders. All European countries protected their newly re-build industries with carefully designed custom duties. Only in the seventies, they gave up their fixed currency exchange rates and the strict financial border control.

Japan and South Korea developed in a very similar way. In the beginning, they protected their young industries behind well-designed tariff walls and other restrictions. Only when the countries were financially strong enough, they opened up for further liberalization.

China develops after much the same pattern. Capital flows across borders are carefully controlled. Foreign investments are carefully watched and selectively chosen. They maintain a low cost of manpower to support their competitive ability. Only when they feel, that their industries have become "mature", they will gradually open for the further liberalisation. It looks like China has a very good success with their development.

Forcing backward developing countries into liberalisation and opening their borders for globalisation too early can be a disaster for such a country. Their small and inexperienced business companies will be no match for the seasoned international companies. In all business areas, will be well-established international companies with experiences, who can make everything better.

The development of poor countries depends not only on trade or not trade. Overpopulation, criminality, corruption and HIV are also very serious problems, that have no direct link with economic globalisation.

|

|

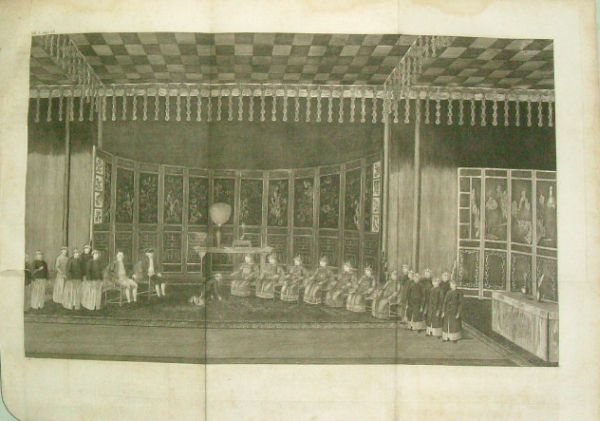

In 1793 England sent a large trade delegation to Peking. Lord Macartney led the delegation. Three ships were filled with all the best products, which English industry and handicraft could offer. There were binoculars, guns, clocks, comfortable coaches and cloths of all kinds.

|

A member of the English delegation in 1793 kneels for emperor Qianlong - The Englishmen refused to perform the required kowtow, which means lying flat on the floor in front of the emperor.

The goal of the delegation was to convince the Emperor Qianlong and his advisors about the benefits of opening China's borders to trade with England.

The expedition failed. The Emperor answered, that China did not need the English products.

During the sixties and seventies, Mao Zhe Dong kept the borders of China sealed against trade with the West.

We love to characterize Qianlong and Mao Zhe Dong as political and economic ignorants, who refused to recognize the obvious advantages of international trade. But the fact was, that they knew, that China could not compete, so they would, logically, not open the borders.

Today the situation is reversed. It is becoming increasingly clear, that the West cannot compete with the low cost in the East. The situation really requires a restriction of the free global trade in order to save our industrial power. However, we have our brains filled with cloudy ideas about freedom and free markets, globalisation and laissez-faire, which all prevent us from thinking clearly and logically.

|

|

| Top of page |